The Black Hole at $SIDU: Where Massive Amounts of Capital Get Sucked Into the Void

The zero-profit satellite company in which the CEO is the landlord, lender, supplier, main shareholder, and main customer.

Executive Summary

In recent quarters, most of SIDU’s revenue has originated from Craig Technologies, a company controlled by SIDU’s CEO, Carol Craig. While this relationship is disclosed in the company’s filings, it raises a structural concern: it calls into question the quality of reported revenue, the independence of demand, and whether reported sales reflect genuine commercial traction. This risk is compounded by the fact that a significant portion of this revenue does not convert into cash and remains recorded as accounts receivable, maintaining ongoing liquidity pressure.

SIDU: Industry Expert (IE) Perspective on a Structurally Unviable Business:

Financial Instability and Contract Risk:

According to a senior space and satellite industry expert with more than 20 years of experience, SIDU’s precarious cash position materially limits its ability to secure meaningful government contracts. Federal agencies prioritize financially stable counterparties to mitigate execution risk, and SIDU’s ongoing losses and liquidity constraints raise concerns about its long-term viability. High-profile announcements such as inclusion on the SHIELD / Golden Dome IDIQ—shared with more than 2,000 companies—were described as largely symbolic, providing eligibility rather than revenue. The expert noted that any potential task orders would likely be immaterial and unlikely to arrive at a pace or scale sufficient to repair the company’s balance sheet, reinforcing a cycle of continued dilution.Lack of Competitive Differentiation or Path to Scale:

The expert assessed SIDU’s offerings as unremarkable across its satellite, engineering, and software verticals. The LizzieSat platform does not meaningfully differentiate from competing smallsat providers, the engineering services offering lacks distinction, and SIDU appears to be a late and underdeveloped entrant in space software. The company’s backlog was characterized as low quality, including contracts with smaller counterparties that themselves require additional equity financing to perform. In the expert’s view, SIDU lacks a credible pathway to scale, margin expansion, or durable, independent demand.Conflicts of Interest and Governance Concerns:

The expert agreed with our findings regarding significant conflicts of interest involving SIDU’s CEO, who also owns and operates Craig Technologies, a private company active in the same business vertical. Shared senior leadership, related-party transactions disclosed in SIDU’s filings, overlapping facilities located approximately one mile apart, and shared corporate addresses further blur the separation between the two entities. These concerns are compounded by repeated capital raises in 2025, amended financial filings, replaced audit reports, and a sudden change in audit committee leadership in January 2026. While no direct evidence of financial wrongdoing has been identified, the expert viewed the timing and pattern of these events as material governance and stewardship risks.

SIDU Space has burned over $100M since going public in 2021, has only produced 3 satellites, and is still losing nearly $2M per month. We believe this is clearly a failed business model, having lost 99.85% of equity value as a public company. There is no indication that the company will turn around.

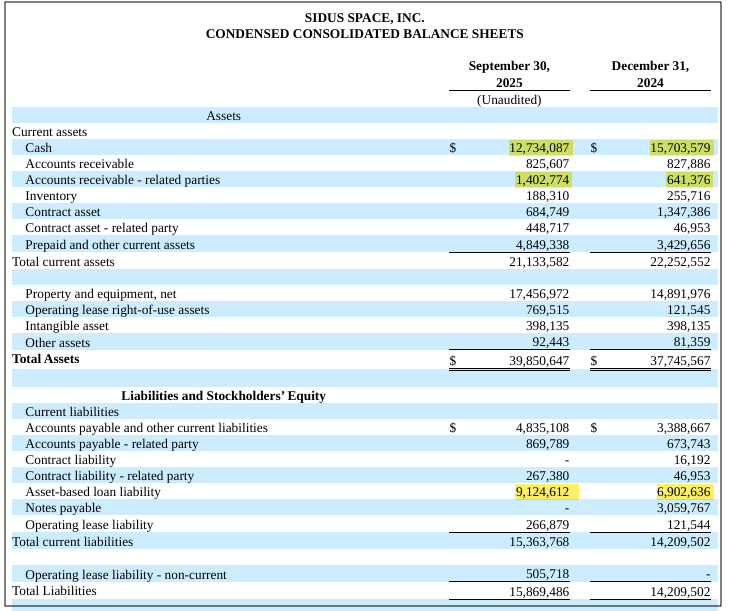

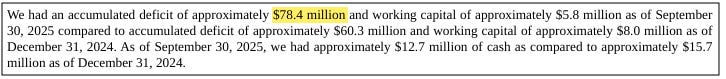

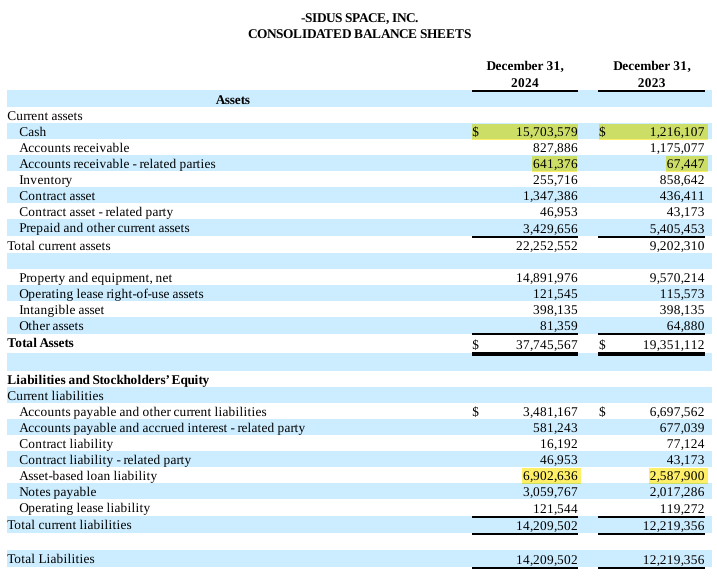

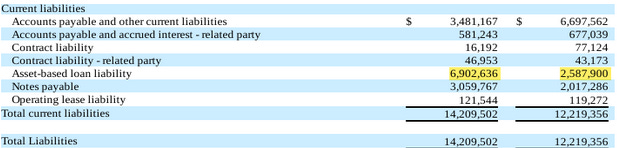

Related-party receivables increased from approximately $67k to $641k year over year, while asset-based borrowing secured against receivables nearly tripled from roughly $2.6M to $6.9M—highlighting that reported revenue is not converting to cash and that equity raises alone have been insufficient to sustain operations.

The company generates modest annual revenue, approximately $4–6 million, while continuing to incur widening operating losses. For the year ended December 31, 2024, SIDU reported an operating loss of approximately $18 million. The only viable sign of operating leverage to sustain operations is further dilution. In practical terms, the business does not sustain itself through its core business operations.

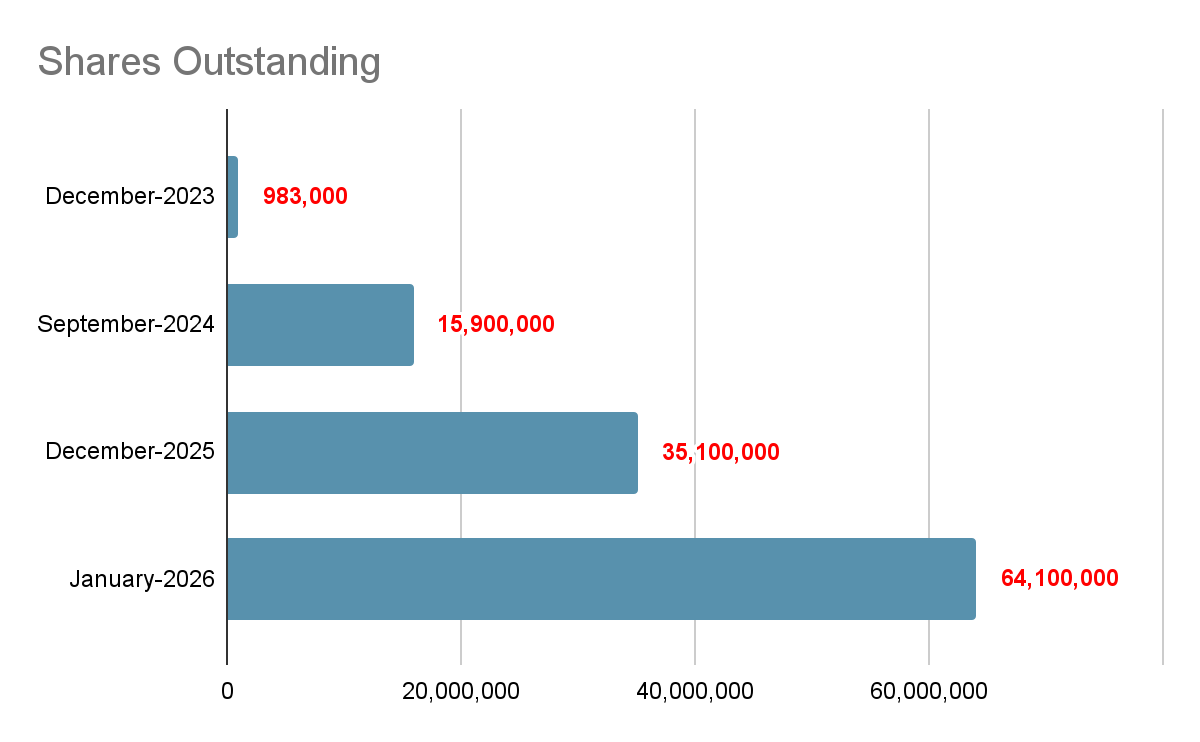

Because operations do not generate sufficient cash to support ongoing activity, SIDU has relied mainly on dilution as its primary financing mechanism. Following a 1-for-100 reverse split on December 20, 2023, in order to regain Nasdaq compliance, the company rapidly re-expanded its share count via equity offerings and warrants. Capital issuance has become the company’s primary source of liquidity - not its core business operations.

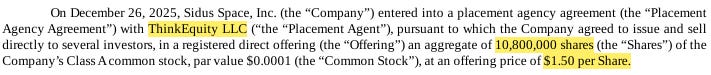

In late 2025, SIDU completed a series of equity raises, including a registered direct offering priced at $1.50 per share. These transactions followed sharp upward movements in the stock price. They were managed by ThinkEquity, reinforcing a pattern in which price rallies appear to function as liquidity windows for new capital raises rather than as signals of improving business fundamentals.

SIDU Financial Summary

Annual Revenue Decline:

In 2024, SIDU’s annual revenue fell to $4.67 million, a 21.64% decrease from $5.96 million in 2023.

The 2023 revenue of $5.96 million was also down 18.24% from $7.29 million in 2022.

Trailing Twelve Months Revenue:

As of Q3 2025, the TTM revenue was 4.19 million, marking a 2.60% year over year decline.

Quarterly Revenue Trends:

Q3 2025 revenue was $1.30 million, which is a decline of 30.55% compared to Q3 2024.

AskEdgar SIDU Co-Pilot Deep Dive

SIDU Operational Forecast

AskEdgar SIDU 10-K Mar 31, 2025

The SIDU Playbook

A “space company” that funds itself by selling stock

SIDU’s filings show that the business does not fund itself through operations. Instead, it repeatedly taps equity markets while riding hype in space, defense, and technology branding.

Step 1: Revenue that relies on a related party, the CEO’s other businesses

A substantial share of revenue comes from Craig Technologies, which is owned by SIDU’s CEO. The disclosure is there, but the signal is weakened: revenue looks less like broad commercial demand and more like a controlled channel.

Step 2: Revenue that doesn’t show up as cash

Much of that revenue remains in accounts receivable. Liquidity pressure remains, and losses continue.

Step 3: Fill the gap with equity… Rinse & Repeat

Because operations don’t pay the bills, SIDU issues stock. More offerings. More warrants. More dilution. No visible improvement in margins.

The 1-for-100 reverse split was not a turning point; it was a reset with fresh capital at the expense of existing shareholders, further devaluing their investment.

Step 4: Selling into strength & keeping the narrative alive

When volume and hype appear, SIDU raises money quickly. The December 2025 deals are a clear example: rapid, discounted offerings executed back-to-back.

Space, defense, national security — the themes stay loud. The economics don’t change. The loop is closed: related-party revenue, receivables instead of cash, dilution to survive, narrative to support it.

The “Craig Money Play”

Money flows between four entities:

SIDU Space

Carol Craig

Craig Technical Consulting (CTC)

Craig Technologies

CTC wins customer contracts, subcontracts work to SIDU, SIDU books revenue, much of it sits in receivables, and SIDU then pays most of the money back to CTC as cost of revenue. This is simple, mostly because SIDU outsources its assembly to CTC.

Example:

-CTC “pays” SIDU $1.38 Million

-SIDU pays CTC back $650 k as cost of revenue

-SIDU owes CTC $870k (to fund operations)

-CTC “owes” SIDU 1.4 Million (carries the unpaid balance)

Meanwhile, Craig benefits through professional services, subleases, administrative fees, and compensation, while related-party revenue grows and SIDU carries receivables.

SIDU Revenue & Receivables

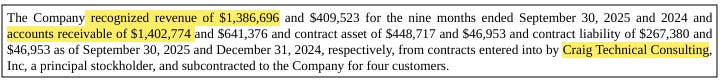

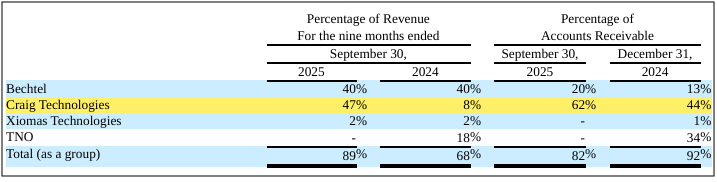

For the nine months ended in September 2025, SIDU recognized revenue of $1,386,696 from Craig Technical Consulting. This represents 49.6% of Total Revenue for the same period. Even more serious is the fact that accounts receivable from Craig Technical Consulting exceed its revenue, meaning Craig owes SIDU more than SIDU has booked in sales from them. The trend is also very telling, with a 239% increase in related party revenue and a 118% increase in accounts receivable from related parties. Which means that SIDU´s reliance on manufactured revenue is only increasing.

Craig as SIDU Biggest Customer and Largest debtor

For the nine months ended in September 2025, Craig Technologies accounted for 47% of total revenue, which means a whopping 488% of relative increase from the same period year over year. Craig Technologies also represented 62% of total accounts receivable, meaning the majority of SIDU’s revenue is unpaid and owed by the CEO’s own company. This highlights overall extreme customer concentration and dependence on non-cash revenue.

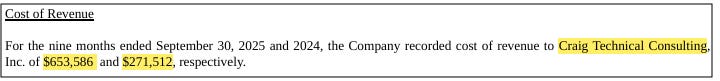

SIDU Cost of Revenue

For the nine months ended in September 2025, SIDU recorded a 141% year over year increase of payments to Craig Technical Consulting meaning that a disproportionate amount of operating costs went to Craig’s own side company, this stops looking like normal operations and more like self-dealing disguised as expense.

SIDU Accounts Payable

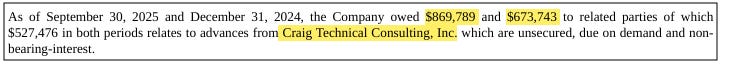

As of September 30, 2025, SIDU owed $869,789 to related parties, a 30% increase from the same period year over year. These advances are unsecured, due on demand, non-interest-bearing, and effectively callable at the discretion of management.

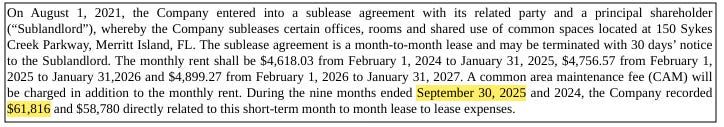

Craig as Landlord

AskEdgar SIDU 10-Q Sep 30, 2025

AskEdgar SIDU 10-K Mar 31, 2025

Under this scheme, in theory, Craig Technologies can practically force SIDU to sell at a loss to its main company, and we speculate that Craig can keep all the profits from any contracts. Craig can also heavily price the manufacturing costs directly to SIDU, making SIDU pay more for any assembly and resulting in losses. Craig can also ramp up SIDU’s rent without prior notice. (As it is its landlord).

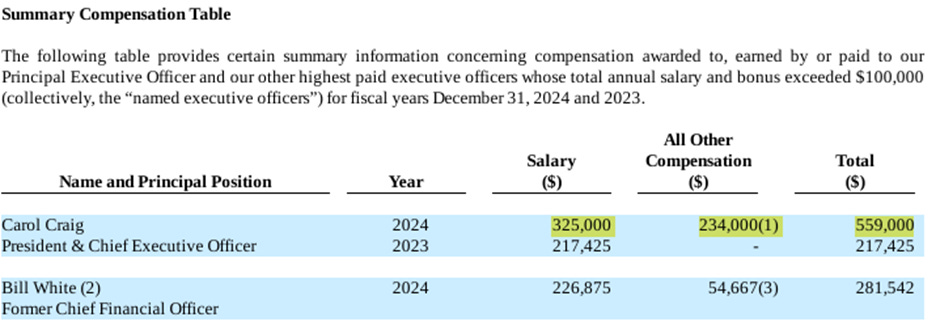

In addition to the fact that Craig is SIDUS’s best customer (amounting to 47% of the revenue), and biggest debtor (62% of accounts receivable) a high-interest creditor, and also receives a juicy salary for a company that burns through cash, has no forecast for the future, and generates zero profit, but that works perfectly well as a circular money play, in which both counterparties are controlled by the CEO.

Inside the Numbers

Losses, receivables, and dilution-funded survival

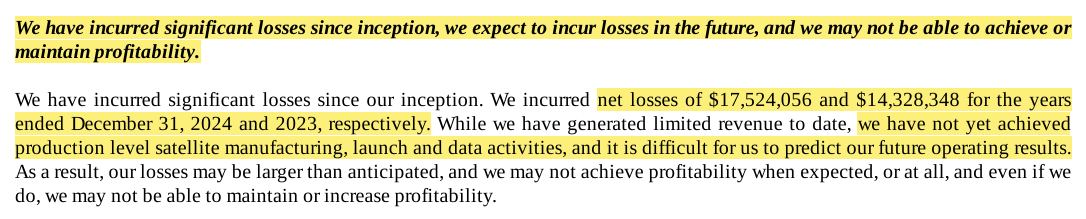

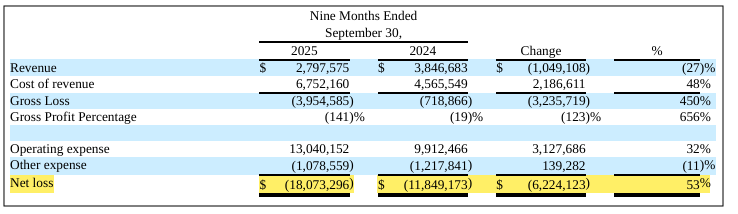

SIDU discloses continued losses:

~$18 million (9 months 2025)

~$11.8 million (9 months 2024)

A 53% increase in Net Loss.

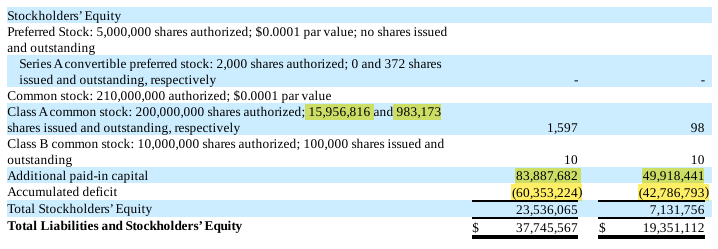

SIDU Consolidated Balance Sheet

AskEdgar SIDU 10-Q Sep 30, 2025

Related party receivables increased substantially, reflecting revenue that does not consistently convert to cash. It is also important to pinpoint the fact that the company is borrowing against receivables, and the loan balance almost doubled in the same period year over year, which is alarming, as it shows that equity raises are not enough to keep the company operational.

Share count expansion illustrates how their losses are funded:

~983k shares (Dec 2023)

~15.9M shares (Dec 2024)

~35.1M shares (Sept 2025)

~64.1M shares (Jan 2026)

Liquidity increases through capital issuance, not operations. Revenue does not reliably convert to cash, losses continue, and operating performance does not materially improve.

Share count expansion illustrates how their losses are funded:

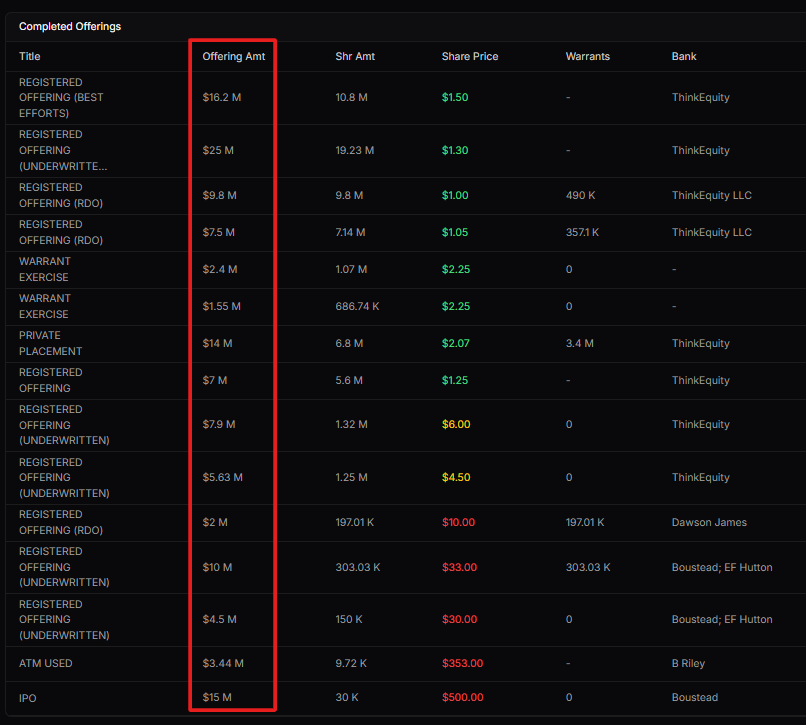

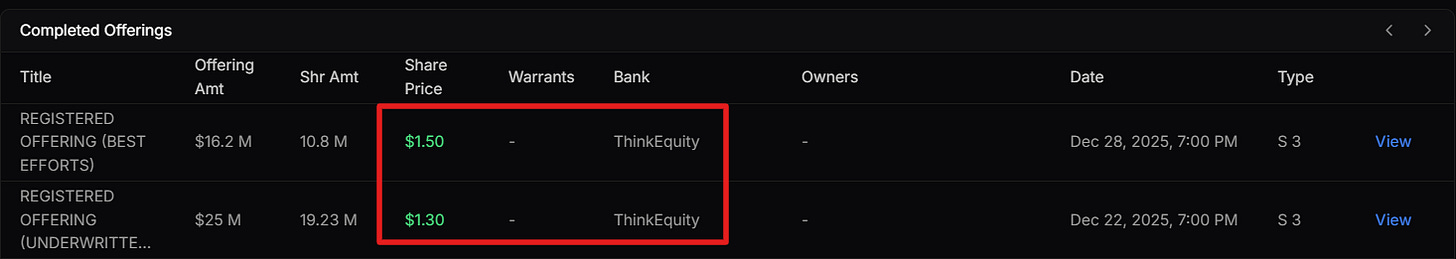

Completed Offerings

Since its inception, SIDU has completed approximately $130 million in equity offerings, registered directs, private placements, warrant exercises, and ATM issuances, as reflected in its offering history. Despite this scale of capital raised, the company continues to burn cash at a rate approaching $2 million per month, having effectively exhausted the proceeds of prior financings without achieving operating sustainability, scale, or durable revenue growth. The implication is straightforward: capital raised to date has funded ongoing losses rather than value creation, and, absent a fundamental change in the business model, SIDU’s continued operations will require additional equity issuance, resulting in ongoing further dilution of shareholders.

Capital Markets Timeline

Reverse split → dilution → repeat

The December 2023 reverse split restored Nasdaq compliance, improved optics, and reopened the door to new offerings — but it didn’t change the business.

Afterward, SIDU leaned heavily on its S-3 shelf to raise cash. ThinkEquity frequently acted as a placement agent, with standard fees and warrants layered in.

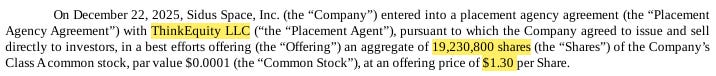

The December 2025 deals highlight the strategy:

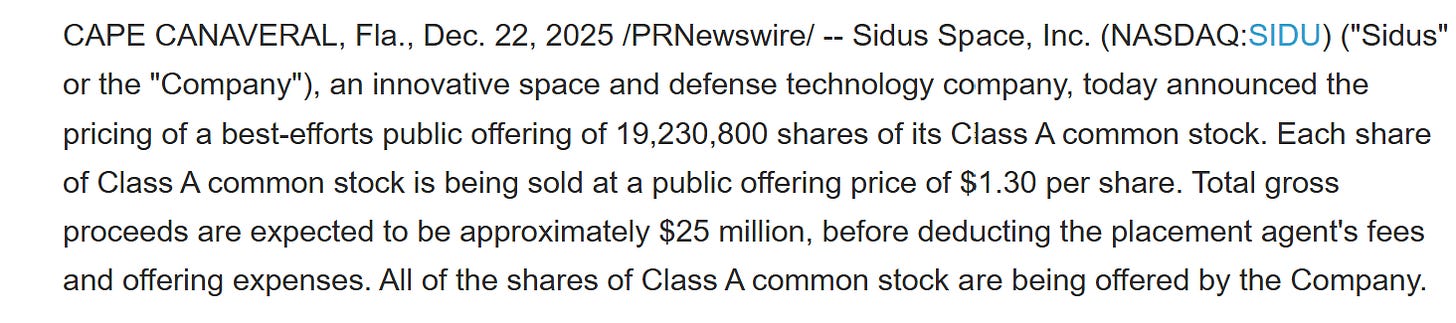

12/23/25 – 19.2M shares at $1.30

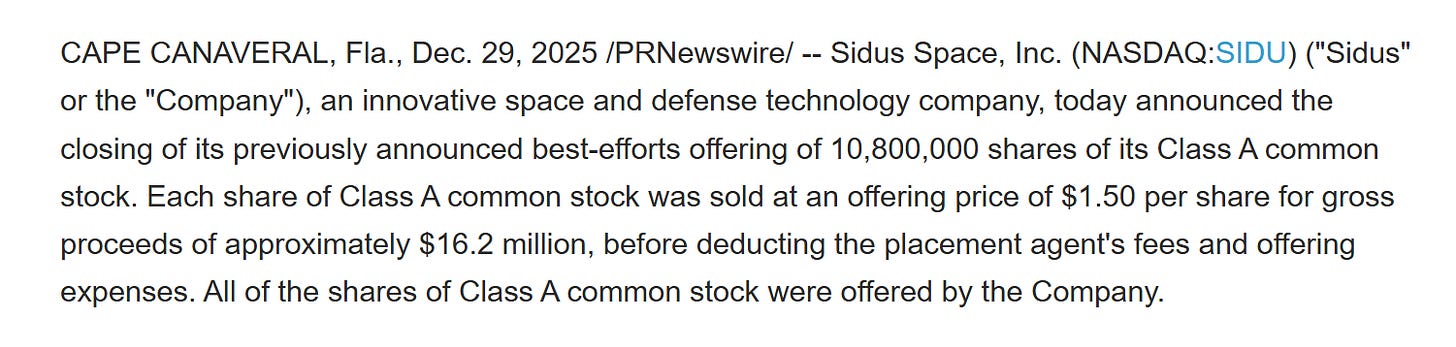

12/29/25 – 10.8M shares at $1.50 + warrants

Both are priced at discounts, freely tradable, and dilutive.

This isn’t one-off dilution. It’s the business's structure and strategy.

On December 22 2025, the company announced a proposed public offering. The following day, $SIDU filed a Form 424B5 for a registered direct offering of 19,230,800 shares of Class A common stock at a public offering price of $1.30 per share, for maximum gross proceeds of approximately $25.0 million. The stock closed at $2.28 on the prior trading day, making the offering price a discount of roughly 43% to the last reported close.

AskEdgar SIDU 8-K Dec 22, 2025

Less than one week later, on December 29, 2025, $SIDU filed an additional Form 8 K announcing a second registered direct offering. In this transaction, the company sold 10,800,000 shares of Class A common stock at $1.50 per share, generating gross proceeds of approximately $16.2 million. The offering included placement agent warrants exercisable immediately at $1.875 per share for a five-year term, issued to ThinkEquity or its designees.

AskEdgar SIDU 8-K Dec 26, 2025

Share Count Re Inflation

After the reverse split, $SIDU rapidly expanded its share count through repeated equity issuance. On December 31, 2023, the company reported approximately 983 thousand Class A shares outstanding. By December 31, 2024, that number had increased to approximately 15.9 million shares. As of September 30, 2025, Class A shares outstanding had increased to approximately 35.1 million.

This expansion occurred alongside continued operating losses and without evidence of operating leverage or margin improvement. The increase in outstanding shares reflects capital raised to fund losses rather than growth driven by operating success. Subsequent registered S-3 offerings in December 2025—19.23 million shares at $1.30 and 10.8 million shares at $1.50—further expanded the share count, bringing the current float to approximately 65.25 million shares.

Source: AskEdgar SIDU 10-K Mar 31, 2025

Source: AskEdgar SIDU 10-Q Sep 30, 2025

ThinkEquity and the Offering Sequence

Throughout this period, $SIDU relied repeatedly on ThinkEquity to facilitate equity transactions. The offerings were conducted under an existing Form S-3 registration statement, enabling the rapid issuance of registered, immediately tradable shares.

In 2025 alone, the company completed multiple equity offerings, including registered direct transactions in July and September. These transactions established a pattern of frequent capital raises rather than isolated financing events.

Source: AskEdgar https://app.askedgar.io/ticker/SIDU/dilution

The December 2025 Back-to-Back Offerings

The December 2025 sequence clearly illustrates how $SIDU monetized market access.

Because the shares were sold under an already effective Form S-3 registration statement, they were freely tradable upon issuance, with no resale lock-up.

The December 22 offering

Source: AskEdgar SIDU Offering Dec, 22, 2025

The December 29 offering

Source: AskEdgar SIDU Offering Dec, 29, 2025

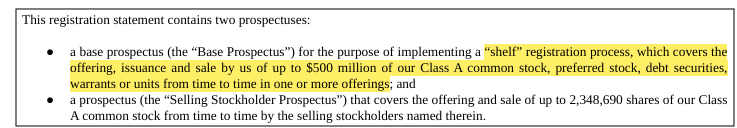

The January 2026 $500 Million Omnibus Shelf

Less than one month after the back-to-back offerings, the company filed paperwork for the next round of dilution. This time, in the form of an S-3 registration, which would allow the company to sell up to $500 million of stock, warrants, and other instruments.

To put this number into perspective, the amount is massive, more than 2 times larger than the company’s current market cap, and to put it into a more dilutive perspective, it would allow them to issue approximately 150 million new shares if they fully use the shelf. (At current prices as of the date of the making of this report.)

For a company that burns approximately $2 million per month and spends $2.41 to generate $1 in revenue, it only means that the latest round of offerings was not enough to keep running. The company plans to keep diluting shareholders until there is nothing left to dilute.

AskEdgar SIDU S-3 Registration Jan, 20, 2026

Capital Markets First Economics

Across these transactions, the economic pattern is consistent. Capital was raised at significant discounts to market prices. Placement agent fees and warrant coverage provided additional compensation to intermediaries. Existing shareholders absorbed immediate dilution, while the company secured liquidity to fund ongoing losses.

The speed, frequency, and pricing of these offerings indicate that equity issuance is not episodic or opportunistic. It is the strategy. Market volatility and space narrative attention create windows of liquidity. Those windows are repeatedly monetized through dilution.

SIDU Space presents itself as a space and defense company, but its true financing shows a completely different picture:

Related-party revenue that doesn’t convert to cash

Recurring losses

Expensive borrowing against receivables

Repeated, aggressive dilution

Minimal independent government work

The true business engine is access to capital markets and insignificant space operations.

Shareholders should understand what they are actually buying, empty narrative and a dilutive business model.

Structural complexity and governance signals

As operating losses widened and dilution increased, SIDU added structural complexity — including amended SEC filings, auditor changes, and an offshore VIE.

Individually, each item is disclosed. Collectively, they increase opacity. None correspond to improved operating results, margins, or cash generation.

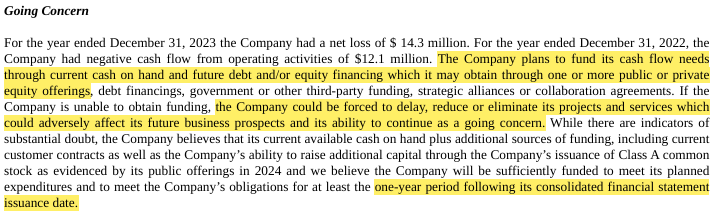

Instead, structural adjustments coexist with persistent losses and reliance on external capital. As the amendment of their Form 10K filed on March 27, 2024, clearly states that the survivability of the company and the ability to keep operating were, even at that stage, a growing concern, and that the forecast is not better nowadays.

Source: AskEdgar SIDU 10-K (Amendment) March 27, 2024

Source: AskEdgar SIDU 10-Q Sep 30, 2025

SIDU’s revenue remains low, while its costs ramp up, and its losses continue to increase. Simply put, they are cash flow negative, while share dilution sustains their existence. The true operation of the business does not change in order to ensure continuity; however, its number of shares outstanding does… That’s why dilution has shifted from being a temporary fix to a recurring financing mechanism.

The upside, meanwhile, depends more on sentiment and hyped-up narrative (essentially pro forma) than on fundamentals.

Downside does not require collapse — only continuation.

The consolidated balance sheet in the latest 10-K reflects the company’s current financial position. SIDU was nearly insolvent by December 2023 and subsequently raised significant capital in 2024. A full 1190% increase. However, as we see in the balance sheet, it was mere capital raising through dilution.

Total equity dilution amounts 1500% more shares outstanding from December 2023 to December 2024. Not only was cash to burn, but the accumulated deficit increased substantially in this same period.

Asset-based loan liability almost tripled, which means that the company is borrowing against receivables at a very high interest rate. From a lender’s perspective, receivables are not clean collateral; therefore, higher interest rates and fees impose damaging capital costs. As of this time, the company is using expensive debt because equity raises haven’t been enough.

Source: AskEdgar SIDU 10-K Mar 31, 2025

Industry Expert Interview – Additional Observations

SIDU’s recent 500% stock move followed a vague PR announcement tied to potential inclusion in the Golden Dome / SHIELD IDIQ, which the expert described as a widely shared eligibility framework—more than 2,000 companies—rather than evidence of contracted demand or near-term revenue.

The expert characterized the quality of SIDU’s backlog as low, highlighting contracts with small counterparties that themselves require additional equity financing to perform, raising concerns around execution, collectability, and true commercial demand.

Even under optimistic assumptions, the expert noted that any potential SHIELD task orders would be immaterial relative to SIDU’s capital requirements and unlikely to be awarded on a timeline capable of offsetting ongoing cash burn, reinforcing a recurring cycle of dilution.

Governance and financial stewardship concerns were reinforced by related-party transactions, overlapping leadership with Craig Technologies, shared facilities and addresses, and a series of developments in 2025, including offshore capital raises, amended filings, replaced audit reports, and a sudden change in audit committee leadership.

“They’ve burned through over a hundred million dollars, put only three satellites on orbit, and they’re still losing close to two million dollars a month.”

Our Final Take

What they reveal is a structure in which:

“Revenue” is heavily tied to the CEO’s own companies

Cash rarely follows the headline sales figures

Government work is far thinner than the narrative implies

Losses accumulate year over year

dilution fills the hole repeatedly

This is not incidental, and it reads like the design of the business itself.

Reverse splits reset the optics, while consecutive offerings refill the bank account. Related-party transactions create the appearance of commercial activity, but it’s just self-dealing. The narrative generates attention — and attention becomes liquidity.

Shareholders fund the story, while the economics remain stubbornly unchanged.

There is no evidence — yet — of a business approaching scale, self-funding operations, or true independent demand. There is, however, abundant evidence that a company’s survival is tied to its ability to continue issuing stock, which is a model built around capital extraction.

Unless SIDU proves it can generate real customers, real margins, and real cash flow — without tapping shareholders as the primary financing source, investors are not stepping into the future of space, but rather a black hole instead.

Investors are stepping into a machine that requires their capital to keep operating, a so-called space company that will likely never launch into profitability, but that will probably get confined into a financial black hole in which not a single dollar from shareholders will see the light again.

Disclaimer

The research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.