$SMX: Going Full Israeli Commando - A 10,000% Nasdaq Pump & Dump

Zero revenue at inception. Zero shareholder value post dilution.

Executive Summary

• SMX has reported zero revenue in every SEC filing to date, despite promoting Israeli molecular-marking technology for more than a decade across the ASX (Australian Stock Exchange) and Nasdaq. The company’s own 20-F and 6-K filings confirm no commercial customers, no contracts, and no revenue-generating activity whatsoever.

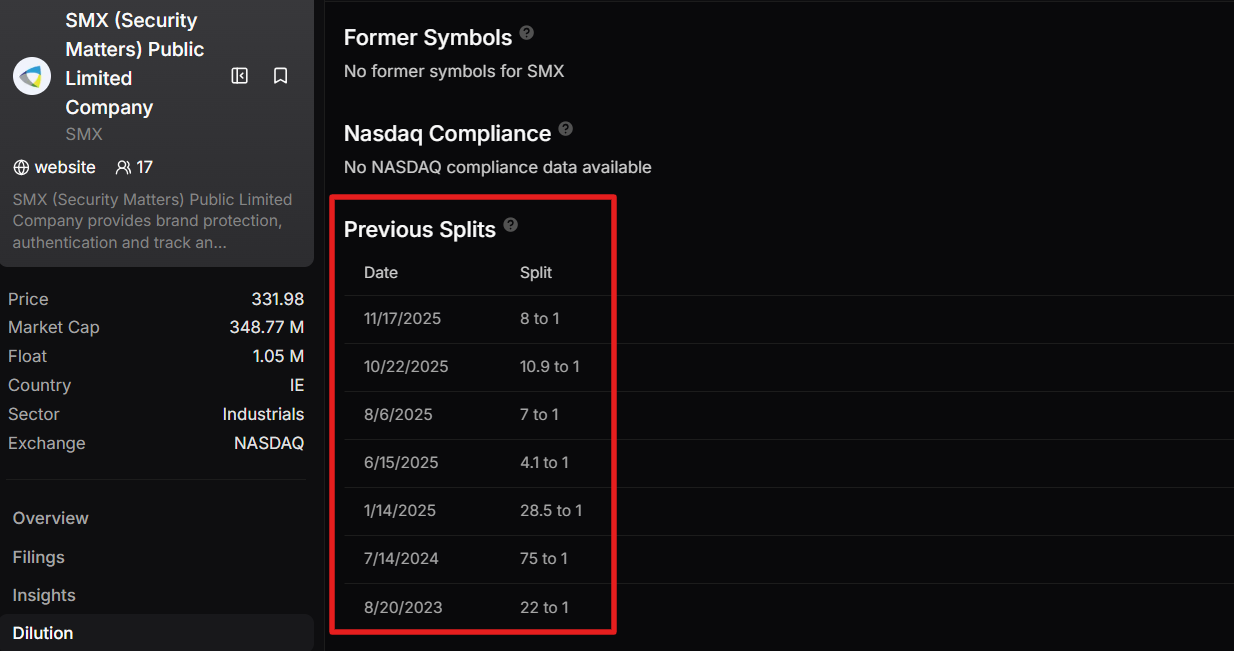

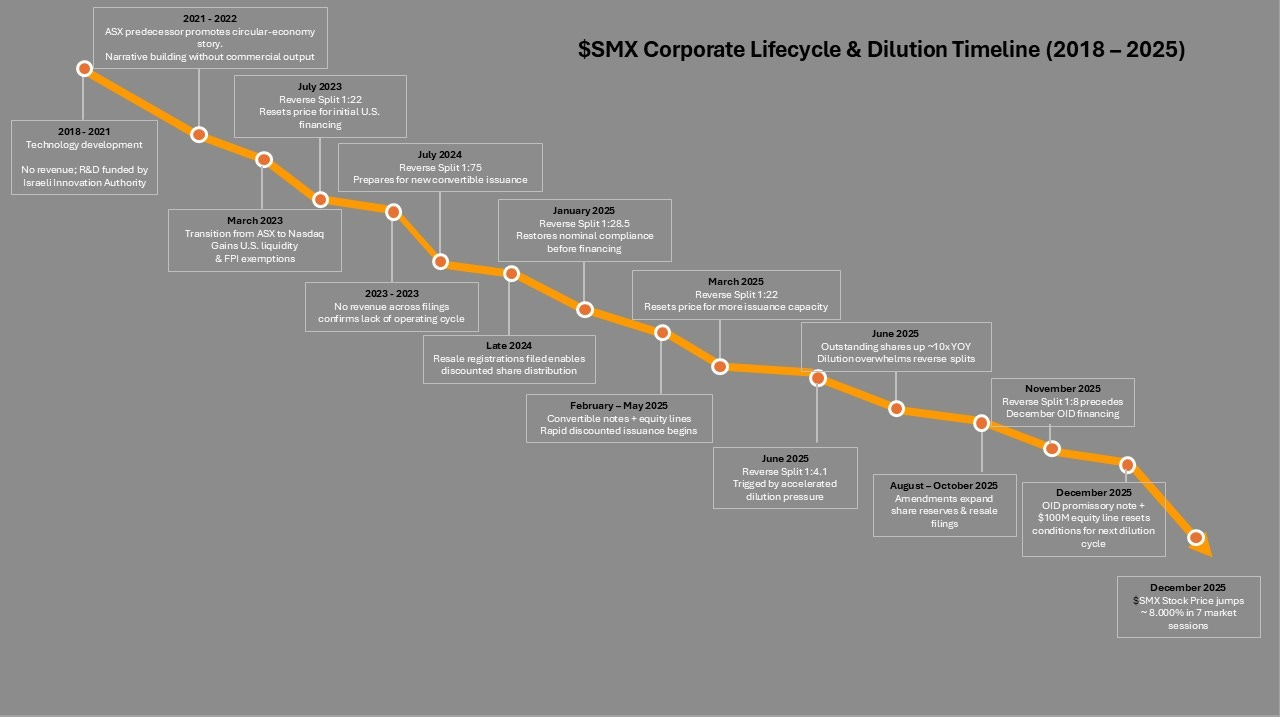

• Over 26 months, SMX executed six separate reverse splits while its share count continued to expand through discounted promissory notes, convertible instruments, warrant coverage, and resale registrations. Each reverse split temporarily restores compliance before the capital structure reinflates through dilution while shareholders lose value.

• SMX’s financing model relies on toxic structures such as original-issue-discount notes, variable-priced convertibles tied to VWAP, and a $100,000,000 equity line that converts at discounts to market. These instruments are designed for rapid resale and create continuous downward pressure on the stock.

• Despite heavy promotional emphasis on an Israeli R&D base and “verification economy” technologies, SMX shows no revenue while shareholder equity collapsed from $11,476,000 in FY 2023 to $1,361,000 by June 2025. The filings show a real, technical team but no commercial output, only mounting deficits.

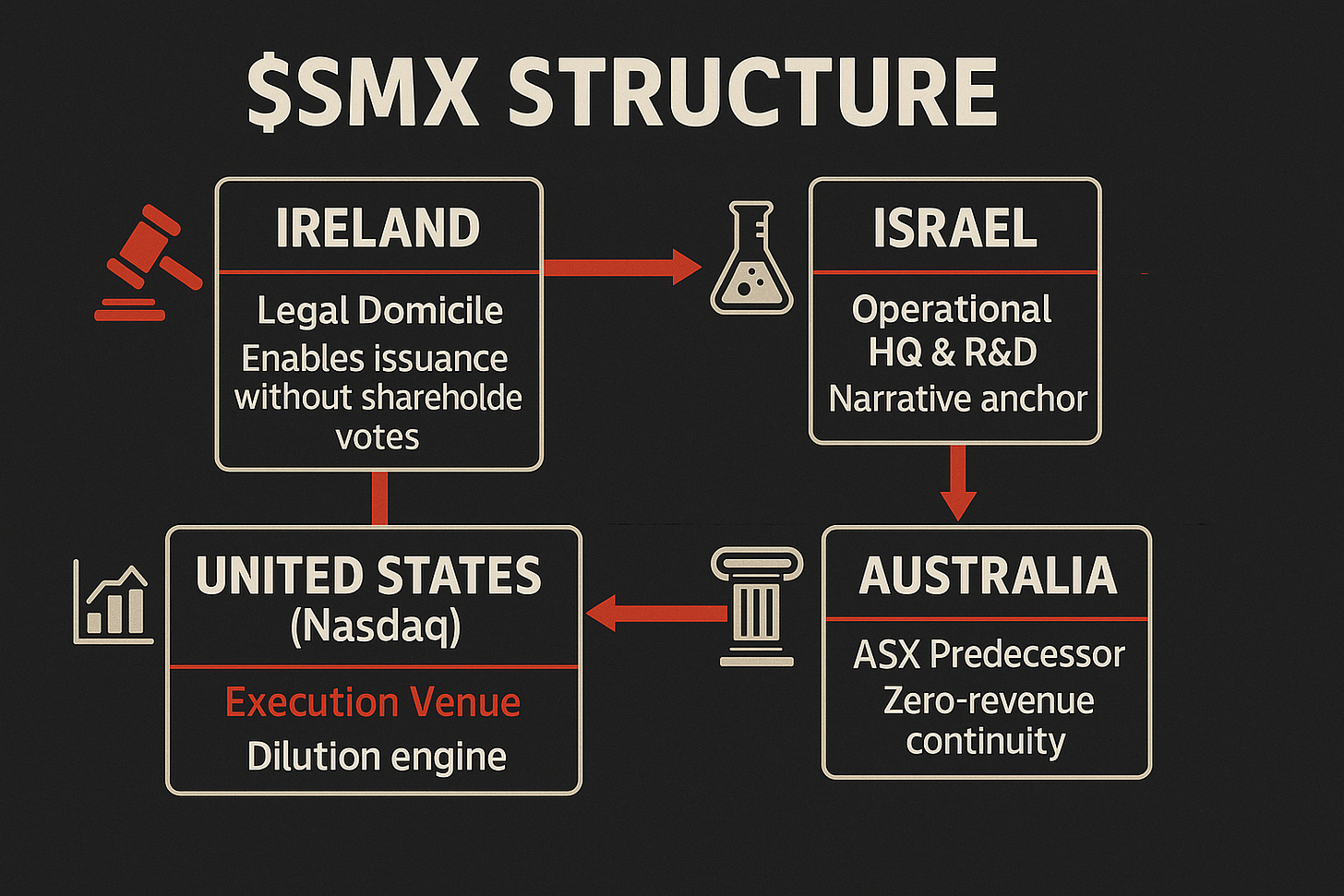

• SMX’s Ireland–Israel–Australia structure, combined with its Foreign Private Issuer status, enables repeated dilution without U.S. shareholder votes.

• The company has paid for a bombardment of more than 40 AI promotional Accesswire news headlines in 7 days. This aligns with a capital-markets scheme rather than a legitimate, operating business.

Company Background

Security Matters Public Limited Company (SMX) is a Foreign Private Issuer listed on Nasdaq and legally domiciled in Ireland, with operational and technical functions in Israel. The company traces its origins to an Israeli R&D initiative and previously maintained a listing on the Australian Securities Exchange before migrating to Nasdaq.

Corporate records show that, since listing in the United States, SMX has executed multiple reverse splits and accessed repeated discounted financing structures. During 2024–2025, the company issued a large volume of promotional announcements, which were distributed across various third-party channels.

Despite these announcements, SMX’s filings continue to show no revenue, consistent operating losses, and a material dependence on external financing. The period from late 2025 shows significant price volatility in proximity to disclosure cycles and financing activity.

The Playbook: SMX Converting Thematic Narratives Into Dilution

SMX begins each cycle with a technology story and ends it with a capital raise. The SEC filings clearly show this pattern. Currently, SMX is sitting on a registered S-3 with the potential to raise $45,000,000 at any given moment following its 10,000%+ surge from under $5 to $490 in the span of 7 days. Shares finished Friday, December 5, 2025, at $331.98.

Corporate filings indicate a repeated sequence: a technology narrative is communicated to the market, followed by discounted financing activity, subsequent dilution, and eventual reverse splits to restore nominal compliance. After the split, additional discounted instruments are issued, and the cycle restarts.

According to SEC filings, SMX currently maintains an effective shelf registration that permits additional capital raising following periods of upward price movement. The company’s filings emphasize technology applications and Israeli R&D origins, while simultaneously reporting no revenue in FY 2024 or the first half of FY 2025.

Financing events described in 20-F and multiple 6-K filings include original-issue-discount promissory notes, convertible instruments priced at percentages of trailing VWAP, associated warrant coverage, and resale registration statements. Collectively, these structures provide external parties with discounted entry terms and rapid liquidity, contributing to expanded share issuance and sustained selling pressure.

Reverse split events disclosed between 2024 and 2025 temporarily reduced the public float before the share count increased again through subsequent issuance. Corporate filings confirm that these splits primarily served compliance purposes and did not alter the company’s revenue profile.

Overall, the filings present a capital-raising pattern rather than operating revenue generation. The combination of discounted financing instruments and reverse splits appears central to sustaining the company’s listing status and its financing activities.

Inside the Numbers

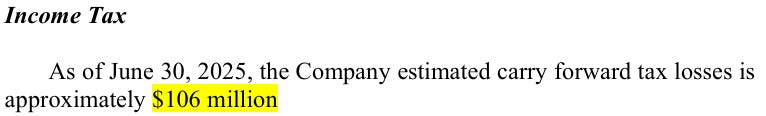

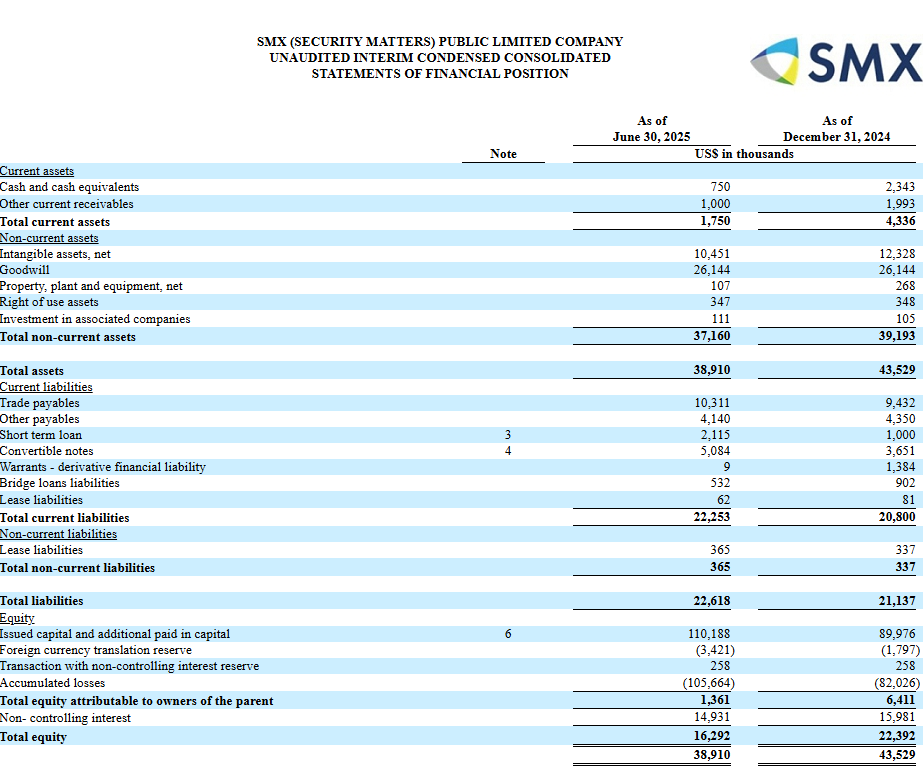

SMX’s financial statements show a consistent pattern across its last two annual filings and its most recent interim report. The company reports zero revenue, persistent operating losses, declining equity attributable to shareholders, and an accumulated deficit that expands each period. These figures form the quantitative foundation of the zero-to-zero cycle described in this report.

According to the May and June 2025 filings, shareholder equity declined from approximately $11.4 million in FY 2023 to approximately $1.3 million by mid-2025. During the same interval, accumulated deficits increased to above $100 million.

Despite repeated financings and multiple reverse splits, available disclosures show no commercial customers and no associated operating cash flow. The documented financial trajectory is consistent with a capital-dependent structure rather than a revenue-driven business model.

Financials and Equity Erosion Since Inception

source: Security Matters for 20-F May 14, 2025

source: Security Matters for 6-k June, 2025

The filings show three sobering facts.

SMX reports zero revenue in every disclosed period.

Losses increase while equity attributable to shareholders declines from $11,000,000 in FY 2023 to $1,300,000 by June 2025.

The accumulated deficit grew from $82,000,000 at year’s end 2024 to more than $105,000,000 six months later. Cash levels remain insufficient relative to liabilities, reinforcing management’s repeated disclosure that future operations depend on raising additional capital.

The numbers do not support a commercial enterprise. They support a financing-dependent issuer that consumes capital faster than it can raise it. Even with fresh cash coming in from convertible notes, warrant exercises, and issuing new shares, the company’s shareholder equity keeps shrinking quarter after quarter. The absence of revenue is not a temporary feature. It is a defining characteristic. The zero at inception leads directly to the zero that remains for shareholders.

Anatomy of Dilution

SMX’s capital structure contracts through reverse splits and subsequently expands through discounted issuance. Corporate filings show that when dilution or price deterioration approaches the Nasdaq minimum requirements, the company conducts a reverse split to restore nominal compliance. After compliance is restored, discounted instruments and resale registrations expand the share count.

Available data indicate at least four reverse splits between mid-2024 and mid-2025, followed by rapid re-expansion of the public float. These actions produced a structural increase in shares outstanding regardless of the nominal per-share reset.

The filings, therefore, reflect a recurring cycle in which reverse splits temporarily reduce the denominator while subsequent financings increase it. Over time, this dynamic materially expands the float despite periodic consolidations.

Seven Reverse Splits in Two Years

Source: AskEdgar — extracted historical Nasdaq corporate action data showing each reverse split executed by SMX between 2023 and 2025.

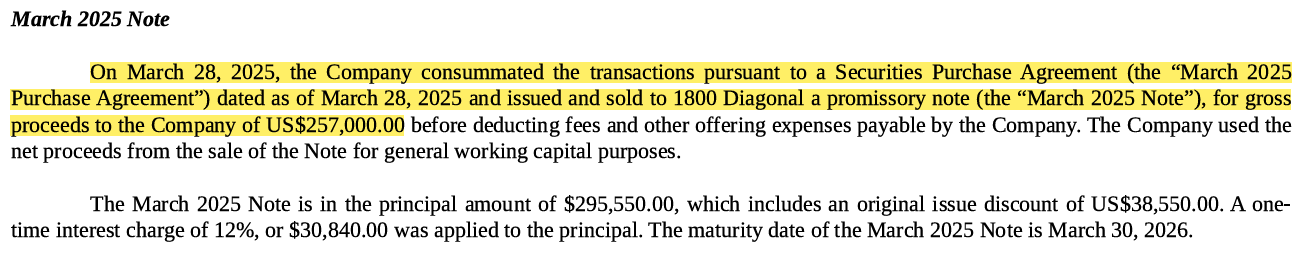

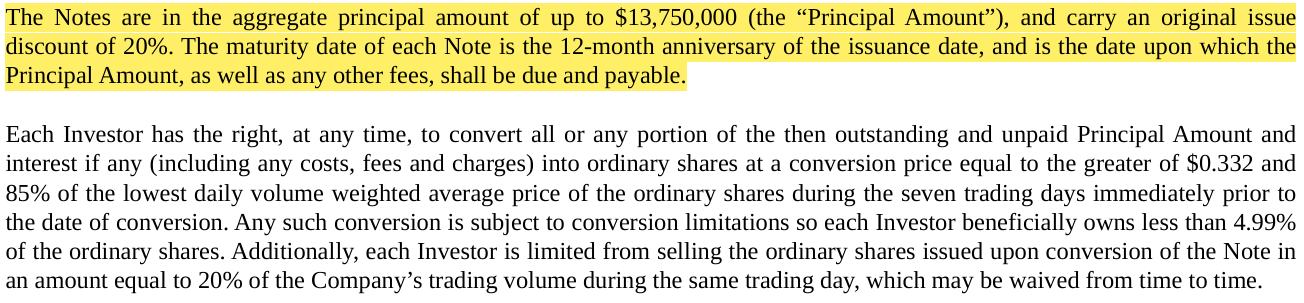

The Toxic Capital Stack

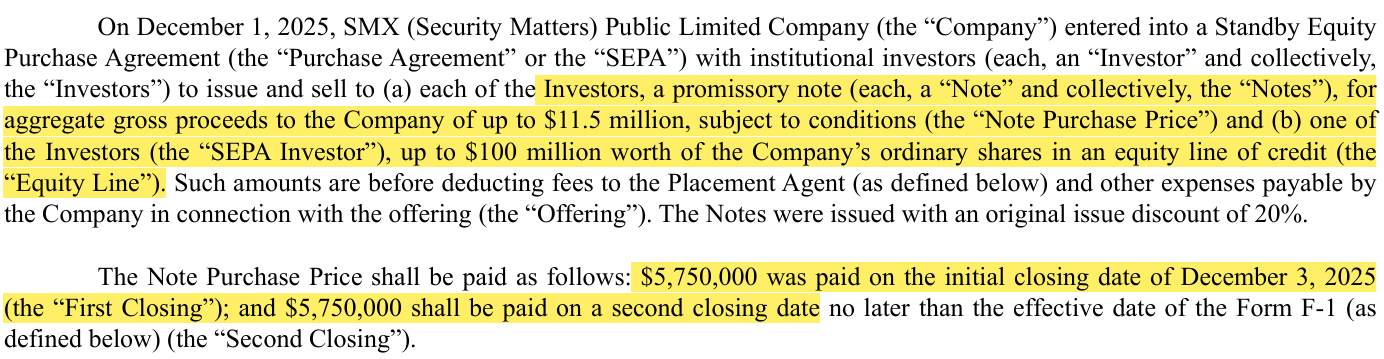

SEC filings from 2023 through 2025 describe financing arrangements that include original-issue-discount promissory notes, variable-priced convertible instruments tied to VWAP, associated warrant coverage, and continuous resale registration requirements for financing parties.

These transactions typically deliver discounted equity to counterparties, and the conversion terms accelerate issuance during periods of price volatility or stress. Subsequent amendments frequently increase share reserves or reset conversion formulas, expanding available stock for issuance.

Corporate disclosures confirm that discounted instruments and equity lines are the company’s principal sources of liquidity. As a result, ongoing operations rely on continued access to financing rather than operating revenue or cash-flow generation.

Taken together, the financing terms formalize a structure in which equity issuance is the primary method of supporting continued operations, with capital obtained through instruments that dilute existing shareholders.

History of Toxic Financing Structures

source: Security Matters for 20-F May, 2025

source: Security Matters for 6-k August, 2025

source: Security Matters for 6-k December, 2025

Term Mechanics:

The March 2025 promissory note comes with a built-in discount, meaning the company receives less cash than the headline amount from day one.

The conversion math tied to VWAP in the later amendments ensures that any equity issued comes out below the prevailing market price, guaranteeing dilution regardless of market conditions.

The August 2025 amendment resets conversion terms and increases the share reserve, expanding the pool of stock available for issuance whenever financing pressure ramps up.

The December 2025 promissory note and equity line layer on floating pricing and immediate resale registration, giving financiers the ability to draw, convert, and sell into the market in rapid cycles.

Each filing requires the company to maintain resale registration so discounted shares can hit the market without interruption.

These aren’t growth financings. They’re extraction mechanisms. The terms ensure that stock is issued at a discount, reset when necessary, and fed directly into the market the moment resale is legally permitted. When the structure starts to choke the share price and threaten delisting, the company performs a reverse split, clears the cap table, and the cycle restarts.

The filings make one thing clear: this isn’t temporary bridge capital. Instead, it is the business model.

Multi-Jurisdiction Structure

SMX operates across several jurisdictions, each contributing different legal and structural conditions. The company is incorporated in Ireland, with operational and technical functions located in Israel. Corporate history includes a predecessor listing on the Australian Securities Exchange (ASX) before it transitioned to Nasdaq, where the company trades as a Foreign Private Issuer.

According to SEC disclosures, SMX follows Irish home-country governance standards rather than U.S. domestic governance rules. Under this framework, the company can authorize discounted equity issuance, expand share reserves, and modify incentive plans without shareholder approval. The structure allows issuance activity with limited U.S. shareholder oversight.

Operational disclosures state that core technological development occurred in Israel, with certain development subject to restrictions imposed by the Israel Innovation Authority. These restrictions primarily concern technology transfer but do not materially impede capital-raising activity.

The prior Australian listing provides historical context, showing that the company’s non-revenue profile pre-dates its Nasdaq listing.

As a Foreign Private Issuer, SMX is not required to file quarterly 10-Q statements and retains greater flexibility in equity issuance and disclosure timing. When combined with reverse splits and discounted instruments, these elements facilitate recurring issuance without requiring U.S. shareholder approval at each step.

This multi-jurisdiction configuration, therefore, enables a financing model in which issuance occurs across regulatory frameworks without a consolidated oversight structure. Filings indicate that this structure is persistent rather than incidental.

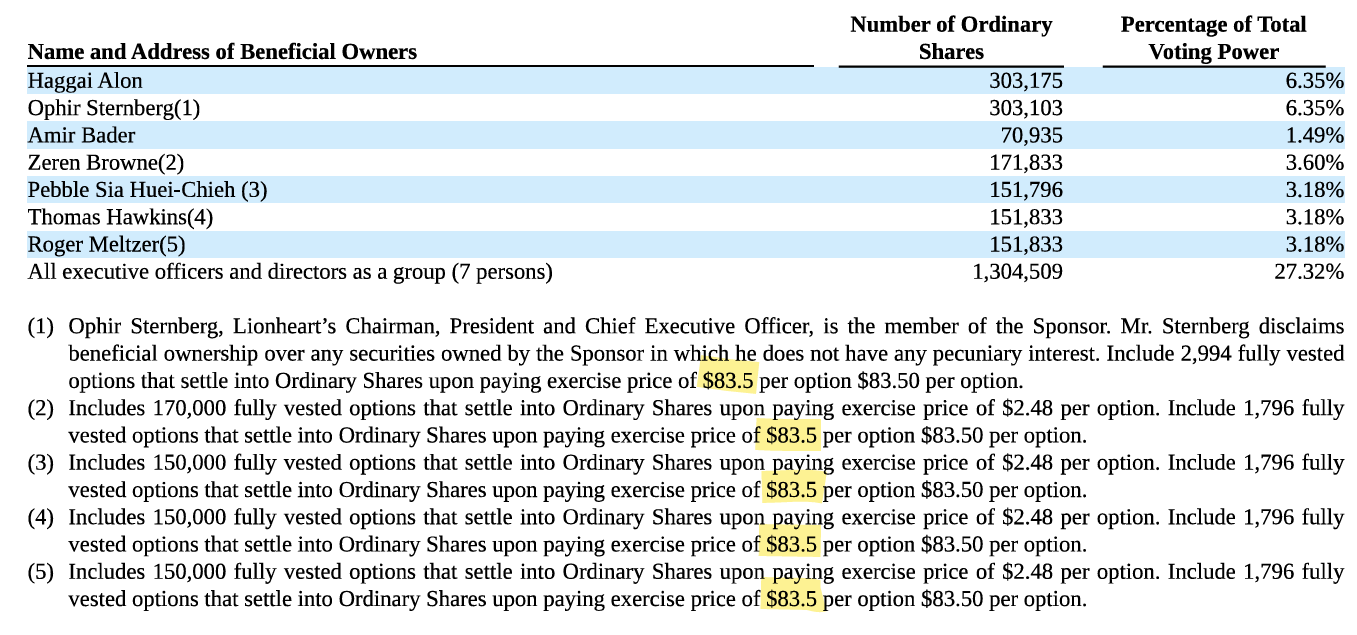

Insider Exposure

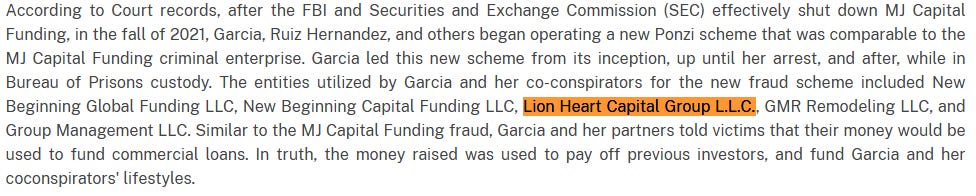

Corporate records indicate that SMX’s leadership includes Israeli founders with backgrounds in research and technology promotion, and a U.S.-based chairman with prior involvement in SPAC and de-SPAC transactions. These backgrounds align with a focus on capital-market access rather than proven commercial operations.

The company’s filings and external sources show that certain executive participants have held roles in entities that experienced substantial dilution and post-merger value deterioration. While these past cases did not establish liability, they illustrate prior involvement in issuers where financing activity and share issuance played central roles.

Additionally, a similar Miami-based entity by the same name, Lion Heart Capital Group LLC, was part of an FBI and SEC shutdown of MJ Capital Funding, which was a Miami-based Ponzi scheme that used the Lion Heart entity and others to defraud. While there is little information connecting Ophir Sternberg’s Lionheart Capital LLC to the now-defunct Lion Heart Capital Group LLC, the connection can be made as both entities are based in the Miami area, where Ophir Sternberg resides is worth noting.

source: Dept. of Justice, Southern District of Florida

Former Israeli Defense Forces Commando and SMX Chairman Ophir Sternberg has been directly involved with companies that show similar traits and trajectories to SMX. These traits include dilution at its finest. The playbook: The company becomes listed as a US exchange, and over a period of time (usually 3-5 years) they dilute shareholders continuously through reverse splits followed by increasing dilution until the company is delisted. Some of these companies include BurgerFi (BFI) and MSP Recovery Inc. (MSPR).

BurgerFi (BFI) Multi-year chart history (Delisted September 2024)

MSP Recovery (MSPR) Multi-year chart history (Currently, .32/share as of December 2025)

The usual Lionheart Capital scheme is to target distressed microcap companies, often providing notes with original issue discounts, VWAP-based conversion formulas, warrant coverage, and resale registration rights. The filings show these entities trading in and out of issuers with comparable patterns of reverse splits and continuous dilution. These listed companies are nothing more than a money grab for insiders and a loss of value for unsuspecting investors.

Together, these participants contribute to a predictable outcome. First, the founders generate a narrative. Second, the chairman structures market access. Third, the financiers monetize volatility. Ultimately, everyone wins except the unknowing investor, as valuation is pummeled by constant downward pressure on the stock price.

source: Security Matters for 20-F May, 2025

Promotional narrative and disclosure quality

A review of public announcements from 2024–2025 indicates a concentration of press releases characterized by generalized language, recurring terminology, and limited disclosure of customers, contracts, or commercial progress. The messaging emphasizes thematic concepts such as “verification,” “global markets,” and “strategic applications,” but filings continue to report no revenue or commercial activity during the same periods.

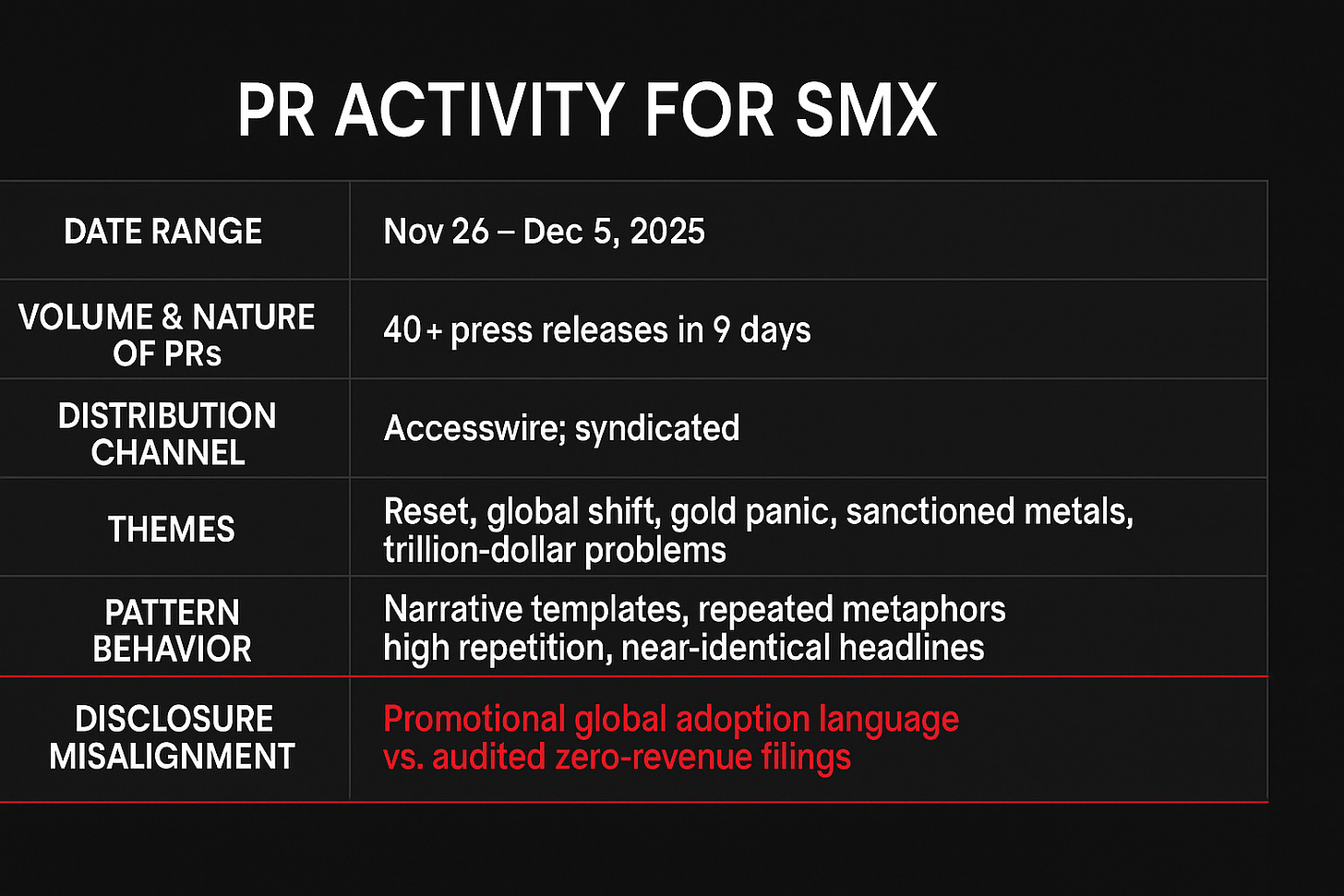

During a ten-day window in late 2025, SMX disseminated more than forty announcements through third-party distribution channels, often repeating similar themes with only minor variations. The volume, timing, and similarity across announcements align with promotional activity rather than conventional corporate disclosure practices.

The absence of corresponding financial disclosures, together with repeated publication intervals aligned with price movement and financing events, suggests that public announcements serve a capital-markets communication function rather than operational reporting.

Comparisons with peer issuers show that the volume of announcements within this period is atypical for a company reporting no revenue and ongoing operating losses.

The company’s press activity also appears temporally associated with significant price movements. As SMX trades on Nasdaq under Foreign Private Issuer status, public announcements may operate as justifications for price activity that might otherwise prompt regulatory inquiry during volatile periods.

Paid Promotional Campaigns

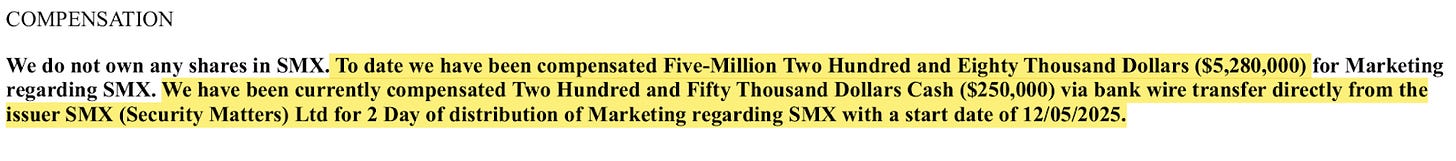

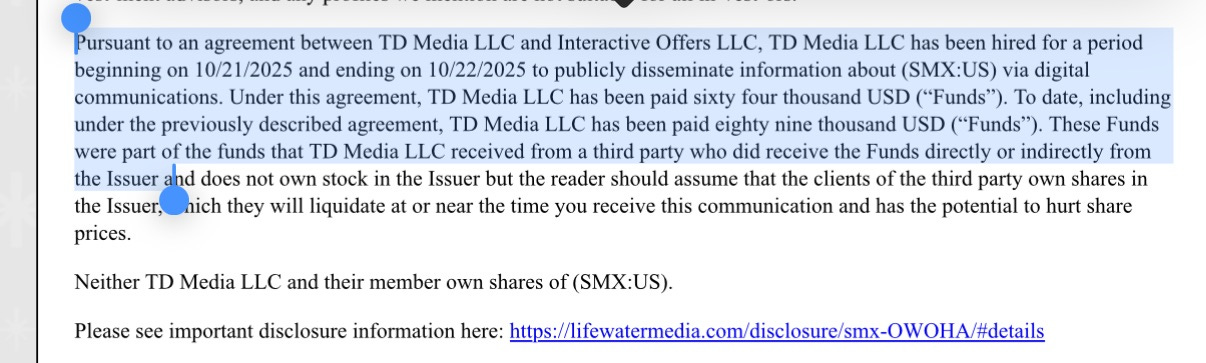

A separate promotional track operated alongside the Accesswire press release saturation. Disclosure statements from TD Media LLC, StockNewsTrends, IR Agency LLC (Stocks.News) and Interactive Offers LLC confirm that SMX was the subject of a paid stock promotion campaign between October 21, 2025, and December 5, 2025. The largest sum from all of these promotional outlets was that of Stocks.news (IR Agency LLC), which was compensated $5,520,000 to date. Specifically, the Stocks.news paid promotional campaigns were funded via wire transfer directly from Security Matters Ltd itself.

source: secretstock.com/smx

The disclosure states that TD Media was paid $64,000 USD and $89,000 USD in total to disseminate promotional content about SMX, and that these funds originated from a third party who received them “directly or indirectly from the Issuer.” The disclosure instructs readers to assume that the third party’s clients held shares in SMX and would “liquidate at or near the time you receive this communication,” creating an explicit risk of price impact. This constitutes direct, on-record evidence of compensated stock promotion operating in parallel with the company’s narrative cycle. (Source: TD Media LLC Disclosure, 10/22/2025)

Timeline of the Scheme

Public filings show a consistent sequence beginning with Israeli-based technological development, followed by a predecessor listing on the Australian Stock Exchange (ASX), and later migration to Nasdaq to access U.S. capital markets and Foreign Private Issuer status.

Subsequent periods feature repeated reverse splits to restore nominal Nasdaq compliance after share dilution, followed by discounted financing events and issuance of resale-registered securities. SEC filings document this pattern across disclosures from 2023 to 2025.

Key stages reflected in filings:

Regulatory Blind Spot

SMX’s status as a Foreign Private Issuer enables it to follow Irish governance standards, reducing the requirement for U.S. shareholder votes and quarterly reporting. This allows frequent equity issuance without the procedural constraints applicable to domestic issuers.

Nasdaq listing rules primarily enforce price-based compliance. Reverse splits temporarily raise the nominal price, enabling continued access to discounted financing. Regulatory filings indicate that price compliance is maintained through structural resets rather than operating performance.

As disclosures occur across multiple jurisdictions—Irish corporate governance, Israeli operational development, and Nasdaq capital markets—no single regulatory authority oversees the complete issuance cycle. The structure, therefore, permits repeated dilution under dispersed oversight.

Public press releases issued during periods of price volatility provide explanations for trading activity that might otherwise prompt regulatory intervention, reducing the likelihood of trading halts during rapid price movement. SMX put out over 40 press releases in the span of 7 trading sessions, likely to circumvent being T-12 halted by the Nasdaq, which would interrupt their pump and dump scheme.

Valuation Reality

SMX’s filings disclose no revenue, sustained operating losses, declining shareholder equity, and a growing accumulated deficit. The balance sheet shows equity decreasing from approximately $11.4 million in FY 2023 to approximately $1.3 million by mid-2025, with accumulated losses rising above $100 million during the same period.

Given the absence of commercial contracts or operating cash flows, valuation is primarily influenced by capital-structure dynamics rather than business fundamentals. Repeated reverse splits change the share denominator, making long-term valuation comparisons based on per-share metrics unreliable.

Convertible notes, equity lines, and discount-based instruments introduce downward pressure on valuation by expanding share supply and establishing conversion reference prices below market. As long as these instruments remain active, increases in nominal price are likely to lead to additional issuance.

The filings emphasize that continued operations depend on external financing. Under these conditions, valuation outcomes follow issuance patterns rather than operational performance or prospective earnings.

Conclusion

There is no justification to support a 10,000%+ rise from under $5 to a high of $490 in the span of 7 days. Available disclosures indicate that SMX operates primarily through repeated capital-markets transactions rather than real commercial activity. Across multiple reporting periods, the company demonstrates consistent reliance on discounted financing, reverse splits, and resale registration events, with no revenue and expanding deficits.

The jurisdictional configuration allows issuance with reduced shareholder oversight and dispersed regulatory review, which leads to accelerated dilution cycles. The filings do not show evidence of commercial revenue or a near-term transition toward an operating business model, making the company a cash-out operation for insiders.

Public filing data in this report was retrieved using AskEdgar’s automated SEC access tools.

Disclaimer

The research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.

Exceptional investigative work on exposing this extraction mechanisim. The way you document the Foreign Private Issuer loophole combined with Irish governance giving them dilution authority without US shareholder votes is exactly the blindspot regulators need to close. What's particuarly damning is the zero revenue across every filing while equity collapes from $11M to $1.3M. That pattern alone should be enough to flag this as pure capital extraction rather than business operations.