Sharplink Gaming $SBET: Ethereum Dream or Dilution Scheme?

Uncovering the red flags behind a micro-cap's ambitious pivot into cryptocurrency.

Executive Summary

SBET has disclosed no Ethereum holdings in any SEC filing.

No ETH wallet, audit, or custodian has been publicly identified.

The $425M treasury claim exists only in a press release.

A reverse split reduced float under 700K just before the offering.

SEC filings show repeated use of highly dilutive financing tools.

The company reports only 5 employees, with no crypto team disclosed.

The offering involved PIPE investors previously tied to major scandals.

Crypto Pivot?

SBET’s $425M private placement was led by ConsenSys, founded by Ethereum co-founder Joseph Lubin, and backed by crypto-heavyweights like Pantera and Galaxy Digital—effectively transforming SBET into the largest ETH-holding public company, raising serious concerns over transparency, governance, and whether this marks a speculative treasury play masked as strategic direction.

SharpLink’s $425M PIPE, led by ConsenSys (founded by Ethereum’s Joseph Lubin), signals a strategic pivot from sports betting to Ethereum speculation. However, no Ethereum assets appear on the company’s balance sheet, no wallet address has been disclosed, and no independent auditor or custodian has verified the claim. The Ethereum treasury narrative is not documented in any SEC Form 10-Q or 8-K. As of this writing, the only source for the ETH strategy remains an unaudited press release and promotional activity across social media platforms — with no verifiable evidence of execution.

We found no disclosed Ethereum wallet addresses publicly tied to SBET, and no ETH holdings are visible in SEC filings or on-chain. If any assets exist, they are likely held off-books or through third parties — raising serious disclosure concerns.

The People Behind It: Rob Phythian & Brian Bennett

Rob Phythian, CEO of SharpLink, has a long history in fantasy sports and betting ventures. His past projects, including SportsHub Tech, have not produced meaningful or scalable business outcomes. Multiple ventures were ultimately reverse-merged or quietly absorbed, with little trace of sustained operational success.

Phythian’s LinkedIn profile is currently live and lists his role at SharpLink. However, it provides minimal detail on his past ventures or qualifications in blockchain or crypto asset management — the very domain SharpLink is now claiming to pivot into.

Brian Bennett, SharpLink’s CFO, was previously involved in the company’s reverse merger with Mer Telemanagement Solutions, a defunct Israeli telecom shell used to take SBET public in 2021. This vehicle had no crypto ties and no growth track record prior to its SharpLink transition.

🔗 Press release confirming appointment and merger structureNeither executive has a publicly verifiable background in Ethereum, blockchain development, crypto asset custody, or treasury strategy. Despite this, they now preside over a $425M “Ethereum pivot” with no on-chain disclosures, no wallet evidence, and no independent audit — raising serious concerns about technical and governance credibility.

SharpLink Gaming, an obscure sports betting firm, has abruptly raised $425M—not to grow its core business, but to stockpile Ethereum in a radical pivot away from sports betting. Just weeks earlier, the company quietly eliminated preferred stock in exchange for pre-funded warrants, followed by a $4.5M offering—moves that appear designed to clear structural obstacles ahead of this surge in stock price.

On May 1, 2025, SharpLink executed a 1-for-12 reverse stock split, slashing the float to under 1 million shares. With such a microscopic float, the setup is ripe for violent volatility, coordinated promotional activity, and—inevitably—heavy dilution.

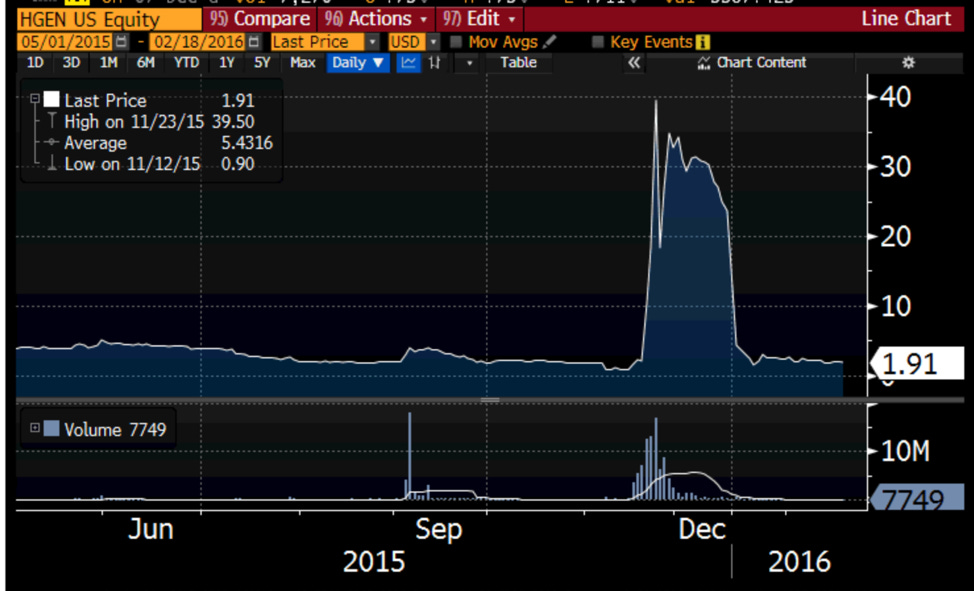

This pattern eerily echoes the infamous 2015 short squeeze engineered by Martin Shkreli on failing biotech KaloBios (KBIO), where he infamously jacked up the price of its sole drug by over 5.000%, igniting retail frenzy and triggering a historic short squeeze. Reckless hype and manipulation sent the stock soaring 10,000% in five days despite no real business foundation. KBIO’s only drug had failed, and it faced over $6 million in debt with no clear path forward.

SharpLink’s recent maneuvers mirror this dangerous playbook.

• Tied to controversial figures like Martin Shkreli

• Backed by notorious PIPE investors (Galaxy Digital, Pantera)

Galaxy Digital: Faced regulatory penalties for promoting and selling Luna tokens without adequate disclosure, leading to a significant settlement

Pantera Capital: founded by Dan Morehead, was an early investor in Coinsuper, a Hong Kong-based crypto exchange that reportedly froze user funds without explanation. This incident raised questions about Pantera's due diligence processes and the oversight of its investments.

• Financials show a net loss from core Operations.

• More of a speculative crypto shell than a serious enterprise.

• The crypto gambling sector is fraught with risk—just look at Zero Edge, where investor funds were misused and the SEC stepped in, underscoring the danger that shadows this unregulated frontier.

• Conflict with previous companies

• Ethereum Foundation liquidating treasury

• Legal & Regulatory Red Flags

SharpLink’s actions raise potential regulatory concerns, including:

Making material claims (such as a $425M Ethereum treasury) through press releases and social media without supporting SEC filings or audited disclosures

Promoting a narrative of crypto asset accumulation without providing wallet transparency, independent audit, or verifiable treasury controls

Using highly promotional communication channels linked to past hype-driven campaigns and meme-based token schemes

The Ethereum claim has appeared across Shkreli-affiliated channels, many of which have been previously used to promote:

Degen DAO

UnfedDAO

Enzyme/KBIO

The structure is nearly identical: hype-based announcements, no filings, anonymous wallet “treasuries,” and coordinated exits. This is not coincidence — it’s a playbook.

Coindesk – SBET shares sink after Ethereum pivot

SBET’s behavior raises serious regulatory concerns, including:

Making material announcements (such as the $425M Ethereum treasury) through press and social media without supporting filings or disclosures

Promoting potentially misleading claims without on-chain validation, third-party audit, or evidence of execution

Raising capital based on unaudited narratives that may lack substance or oversight

The SEC has taken action before in similar cases — such as Long Blockchain, CYNK, and BitConnect — where promotional stories were used to drive stock hype, followed by dilution or collapse. SBET appears to follow this same “narrative + exit liquidity” pattern.

We believe $SBET is extremely high-risk and a potential cash vehicle for insiders to get rich at the expense of naive retail investors.

SharpLink Gaming ($SBET) – High-Risk, Likely An Orchestrated Scheme in the Making

We are initiating investigative research on SharpLink Gaming (NASDAQ: SBET), a company we believe poses significant risk to public investors due to questionable financial practices, alarming strategic pivots, dubious insider involvement, and associations with controversial figures and institutions. This is not a traditional business—it’s a potential vehicle for massive dilution and speculative manipulation.

1. A $425 Million Ethereum “Treasury”?

A) On May 1, 2025, SBET announced a 1-for-12 reverse stock split. This resulted in a new public float of less than 700,000, which was ripe enough to manipulate for a short squeeze scheme.

B) Earlier this year, SharpLink filed for a 4.5 million at-the-market offering, signaling imminent dilution and raising questions about the company’s intentions.

C) On May 20, 2025, SBET announced a public offering of 4.5 million shares, which included pre-funded warrants with an exercise price of 2.94. The warrants were likely held and not sold, as Martin Shkreli pointed out on his X post on May 29, 2025 — mirroring his KBIO playbook from 2015.

D) On May 27, SBET announced a $425 million private placement, selling 69.1 million shares at $6.15 each to build an Ethereum “treasury.” These shares are locked up, leaving less than 2 million in the public float — a setup that fosters extreme volatility and opens the door to market manipulation.

E) Finally, SharpLink initiated a larger ATM offering program by filing a Form S-3 ASR with the SEC on May 30, 2025, allowing for up to $1 billion in common stock issuance.

2. Illusory Profitability

SharpLink reported net income of $10.1 million in 2024, but a closer look reveals this was entirely driven by a $14.57 million gain from discontinued operations. From continuing operations, the company posted a $4.47 million loss. This is consistent with its poor financial performance over time — including $11.25 million in losses in 2023.

The “turnaround” narrative is misleading and does not reflect the operational reality.

3. Dubious Strategic Shift into Crypto

SharpLink’s sudden pivot to an Ethereum-based treasury strategy is unsupported by any disclosed blockchain infrastructure, operational plan, or technical personnel. The company has no history in crypto, and as of its latest filings, no ETH appears on its balance sheet. Yet $425M was raised through a private placement tied solely to this narrative.

This move appears to mirror a broader pattern seen in speculative microcaps — where failing businesses adopt high-profile crypto themes to spark investor interest without delivering real execution or transparency.

4. Martin Shkreli – A Red Flag Personified

Disgraced pharma executive Martin Shkreli has publicly disclosed a personal investment in SBET and commented on its low float — this from an individual banned from serving as an officer or director of any public company. His involvement raises reputational risk and potential influence concerns.

Speculative Hype Alert: On May 29, 2025, Shkreli posted about SBET’s float and upside potential, stating it “may go to $500–$1000,” despite adding “do not buy.” His history of attention-grabbing crypto commentary — often followed by extreme price moves — has been seen in several questionable projects.

Shkreli’s Most Notorious Crypto Involvements:

DJT Token (TrumpCoin)

Rode a massive hype wave, hitting a $55M market cap

Collapsed 90% after a $2M dump from a single wallet. Shkreli denied responsibility, though blockchain evidence indicated close ties

On June 19th, blockchain sleuths found that the DJT token Telegram group shared admins with another Shkreli-affiliated token

Claimed it was co-created with Barron Trump (Trump’s youngest son), though no supporting evidence was provided

Martin Shkreli Inu (MSI)

Meme coin allegedly “hacked” by Shkreli’s own wallet.

Coin was integrated into his biotech platform Druglike.

Token value tanked 90% after a massive sell-off from a wallet funded by Shkreli himself.

SharpLink Gaming (SBET)

Martin Shkreli disclosed a position in SBET after it surged over 1,000% on Ethereum-related news. The stock had a low float and minimal institutional ownership, making it highly susceptible to manipulation.

He publicly discussed the trade while warning others “not to buy,” a familiar tactic observed in previous speculative cycles.

Shkreli claimed that the newly issued shares were locked for 6 months, which reduced the effective float and helped trigger a short squeeze narrative.

While the shares were locked, control of the float shifted to retail and promotional actors. Once price momentum peaked, these players could exit — creating a setup where the stock was vulnerable to a sudden collapse once selling began.

5. Shady Players in the PIPE

On May 27, 2025, SharpLink Gaming (NASDAQ: SBET) announced a $425 million private placement — a staggering sum for a microcap firm with limited crypto experience.

Participants in this round included funds and individuals previously linked to controversial activity:

Galaxy Digital settled a $200 million case with the New York Attorney General for promoting Luna while secretly exiting positions before its collapse.

Pantera Capital founder Dan Morehead was reportedly under investigation for potential tax avoidance. Reports also highlight Pantera's history of exiting TerraUSD before it's crash — raising questions about ethical trading behavior.

Conclusion: Investor Beware

SharpLink’s core business has shown little evidence of sustainable revenue or growth, yet the company continues to pursue dilutive financings and promotional efforts to prop up its valuation. Following the collapse of its sports betting ambitions, SharpLink has attempted to redirect investor attention toward a highly speculative pivot into crypto, backed by controversial PIPE investors with a track record of questionable dealings. This pattern mirrors the trajectory of other microcap companies that pivoted into blockchain hype cycles, only to leave retail investors holding the bag. Given the company’s weak fundamentals, history of capital raises, and lack of clear strategic direction, we believe SharpLink is setting up for a significant dilution event. We urge investors to proceed with caution.

Final Words

SharpLink is a story. Not a company.

There is no business. No ETH. No disclosure. No future.

What exists is a narrative crafted to create exit liquidity for insiders, connected figures, and PIPE investors — all while retail is distracted by buzzwords like “Ethereum treasury” and “DAO pivot.”

Retail will be left holding the bag. And once the stock tanks, the damage will be irreversible.

This is not a pivot. It’s a crypto-flavored liquidation event.

Disclaimer

The research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.

Fugazi Research is not investment advice. All statements made in Fugazi Research reflect the author's personal opinions. The author of Fugazi Research does not hold short positions or financial interests in any companies discussed.