$RIME: Where Slumdog Trucking Becomes AI Hype and Runs Over Investors

From mediocre karaoke machines to slummy Indian roads where AI is meaningless.

Fugazi Research Analysis

RIME rebranded itself from The Singing Machine Company (MICS) to RIME (Algorythm Holdings) in September 2024, mostly to pivot away from its previous reputation as a cash-burning, highly dilutive, and negative cash flow business involved in shareholder litigation.

On Friday, 2/13/26, the company appeared on Fox Business for a brief 3-minute call via a Zoom-like livestream, where the CEO mentioned a white paper. The white paper caused a “DeepSeek”-type panic in over a dozen stocks in the freight industry. This provided cover for toxic financier Streeterville Capital who needed liquidity to dump shares without completely plunging RIME’s stock price. Adding to this was the fact that the white paper link on the company’s website was broken and inaccessible. The white paper turned out to be wishful thinking, with no real numbers, no real technology, and no real revenue forecast from an unproven “AI” company that had been selling karaoke machines less than a year earlier.

The primary beneficiary of debt convertibles and follow-up dilution is Streeterville Capital, controlled by computer scientist John M. Fife, a well-known toxic financier who holds $20 million of convertible securities at preferential prices. The outstanding shares can increase by more than 40%, and the public float can increase by more than 300% once convertibles are fully exercised. Fife is required to sell shares to maintain ownership below the 9.99% cap, creating a vicious cycle of continuous downward selling pressure.

John M. Fife has a prior history of regulatory non-compliance, as he was charged by the SEC for operating an unregistered dealing business from 2015-2020. The SEC charged Fife and his various entities, particularly for convertible note transactions involving penny stocks and for selling newly issued shares while evading mandatory dealer registration.

The majority of the company’s revenue comes from SemiCab, an Indian subsidiary that provides traditional logistics services. This is an underdeveloped, third-world wholesale freight business with no proven AI-powered technology or innovative mechanics, despite RIME’s AI claims. The financials of this foreign subsidiary cannot be easily verified or overseen by investors, as it is registered in Bangalore, India.

Streeterville will keep converting its debt into discounted shares and selling them while driving the price down further, while Fife will keep extracting millions in profits, leaving unaware shareholders with nothing.

Due to the death spiral dilution mechanics, the fake AI narrative trying to mask an underdeveloped, rudimentary Indian freight business, and the inevitable path to zero, we consider RIME’s shares completely uninvestable and worthless.

RIME Financial Summary

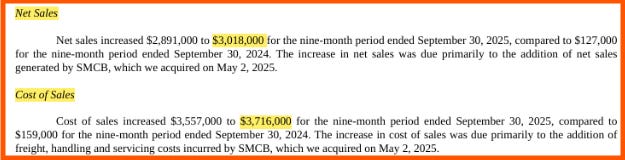

For the nine months ended September 30, 2025, revenue totaled $3.0 million, but net loss for the same period totaled $13.1 million, meaning the company lost more than $4 to generate $1 of revenue, or a -433% net margin.

Loss from operations increased from -$6.14 million to -$13.93 million, a staggering 127% year over year increase, signaling that the only path forward is continued toxic financing and dilution.

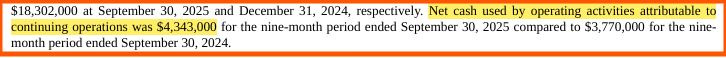

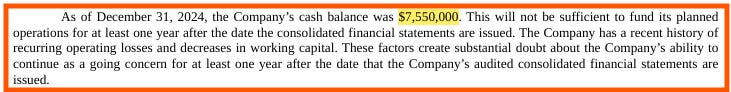

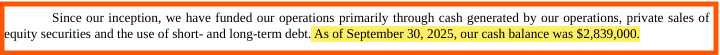

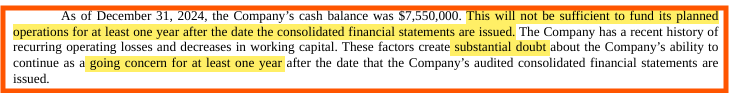

Cash burning acceleration rate is increasing, as cash declined from $7.55 million at December 31, 2024, to $2.84 million at September 30, 2025, signaling a 62% collapse in cash availability in less than a year.

Outstanding shares increased from approximately 2.7 million as of November 17, 2025, to 5.76 million as of January 21, 2026, a 113% increase, translating into 50% shareholder dilution in less than three months.

The company is operating at an extreme leverage ratio, with total assets of $10.8 million and total liabilities of $10.7 million, translating to a 107x leverage ratio, signaling an unavoidable financial collapse.

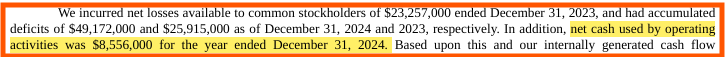

In their latest 10-K, the company acknowledges its negative going-concern status and its inability to fund operations for even a single year at current cash-burning rates.

Source: RIME Form 10-K year ended December 31, 2024,

Source: RIME Form 10-Q quarterly period ended September 30, 2025

Executive Summary

In September 2025, RIME rebranded from the Singing Machine company to Algorythm Holdings, in an apparent play to wash away its previous reputation as a cash-burning, serially dilutive company.

Behind the company’s main financial structure is Streeterville Capital Management, owned entirely by computer scientist John M. Fife, who is a well-known unregistered penny stock dealer, toxic financier, and SEC violator, who was previously charged by the securities commission on several occasions due to failure to notify resales, convertibles, and being involved in pump and dump schemes with penny stocks.

Fife is known to run predatory algorithms to run up stocks for liquidity in order to obtain massive profits by dumping his heavily discounted shares onto unwary investors, a pattern that has prevailed through several years and spans several penny stock companies, leading to their bankruptcy and eventual delisting from the markets.

RIME capitalized on a sell-the-news event due to the freight industry downturn, in mid February 2026, in which they went on Fox Business News on a three-minute segment where they tried to project a well-established AI freight business model. This business model is unproven and not factually true. This narrative is trying to capitalize on increased liquidity and volume, in which the only beneficiary was Streeterville and specifically John M. Fife.

The only path forward for the company is a continuous death spiral of dilution, in which the shares will reach near zero, and the company will most likely be delisted in the not-so-distant future. This has been the playbook, and ultimately the fate of previous companies Fife has been a part of.

The Playbook

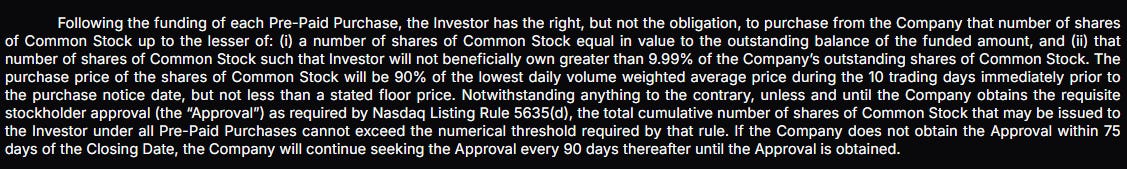

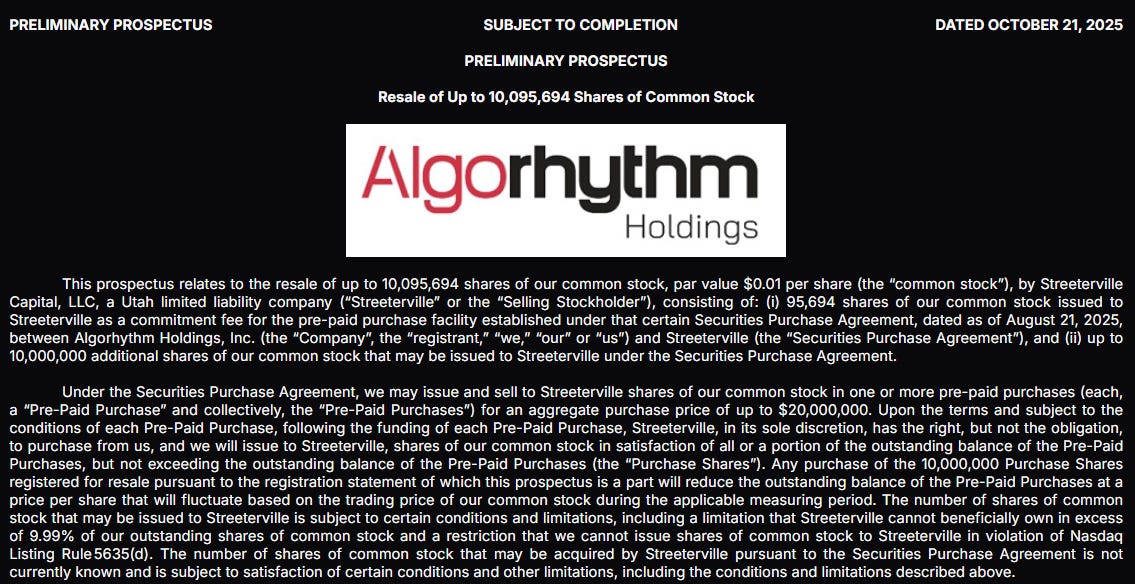

Rebranding out of karaoke and into an “AI freight” story, Algorhythm signed a secured pre-paid purchase agreement with Streeterville Capital. The Securities Purchase Agreement and the Pre-Paid Purchase attached to the August 27, 2025 Form 8-K set out a simple structure: Streeterville wires in cash, Algorhythm records a fixed-dollar obligation, and that balance can be repaid over time in stock valued by formula rather than a one-off negotiated price.

The specifics in the filing define that formula. Shares delivered to Streeterville are priced at 90% of the lowest daily VWAP over the 10 trading days before a purchase notice, with a floor price below. When the ten-day window trades lower, the same dollar of balance requires more shares; when it trades higher, fewer. The stated principal on the Pre-Paid Purchase already reflects an original-issue discount and fees, so the headline figure is larger than the cash that actually reaches the company. In practice, the instrument behaves like a VWAP engine that keeps looking back at the tape to decide how much stock it will take to clear each slice of the obligation.

Source: RIME Form 8-K Ex-10.2 August 21, 2025

A 9.99% beneficial ownership cap sits on top of that math. Streeterville is not allowed to hold more than 9.99% of Algorhythm’s common stock at any moment, but the agreement checks this level as a snapshot. If Streeterville receives shares under a purchase notice, sells into the market, and falls back below the threshold, the contract permits further purchase notices on the same 90% of lower VWAP terms, as long as there are authorized shares and Nasdaq Rule 5635(d) is satisfied.

Once shareholders approve issuance beyond the 20% exchange cap, the ownership limit operates as a revolving gate: stock moves out below 10%, cash flows back in, and the capacity to issue opens again.

The resale requirement turns those terms into a financing line. Under the 8-K, Algorhythm must file a Form S-1 registering the resale of shares issued under the Pre-Paid Purchases. When that S-1 is effective, a prospectus and any 424B supplements are on file, stock issued to Streeterville sits under a live registration statement, and can be sold into the market under that shelf. Combined with the ten-day VWAP lookback and the point-in-time 9.99% cap, the facility functions as an option on liquidity: when volume appears, and the S-1 is in force, balance can move into stock and stock can be turned back into cash.

The public layer atop this structure is the SemiCab narrative. RIME recast itself around a digital freight network described as an AI orchestration platform for trucking, then pushed that story hard in early 2026. A GlobeNewswire release linked to a SemiCab “industry white paper” claimed more than a 70% reduction in empty trucking miles on live freight networks and pointed to deployments in India as the example and setting for those results. Days later, a second release cited another white paper and stated that customers using the platform were handling three to four times the freight volume without adding staff, again with India presented as the example operating environment.

The “DeepSeek Moment”

On February 13, 2026, chief executive Gary Atkinson appeared on Fox Business’s “Making Money with Charles Payne” and presented a “white paper” SemiCab as a solution for empty trucking miles, repeating the 70% reduction language and framing Algorhythm as freight infrastructure rather than a recycled consumer-audio listing.

Above: RIME’s weblink to the “white paper,” was likely unlinked intentionally and is broken as of this publication most likely to create panic and uncertainty among stock traders.

At the same time as CEO Gary Atkinson’s appearance on Fox Business, a suspiciously large volume instantly started trading the stock, consistent with algorithmic “walk up” patterns, providing a perfect opportunity to run the stock up by 200% during the trading session.

Atkinson tried to capitalize on a “DeepSeek”- type moment from the previous day, when major freight industry players lost an average of about 10% of market cap due to AI fears. However, these fears proved unfounded, creating a buying opportunity for the whole sector, which then dropped for next to no reason.

After the market closed on Thursday, the freight industry stocks sobered up from the original panic, and analysts such as Benchmark’s Christopher Kuhn shot down the claims of Algorythm Holdings, citing that the small market cap and the outrageous and unsustained claims of the previous “Manufacturer of Karaoke Machines” was just taken out of proportion, as many of the industry leaders already perform shipments with the help of AI agents, increasing their productivity over the past few years.

A Barron’s article featuring commentary from Benchmark analyst Chris Kuhn, highlighted these issues, and in turn, Barron’s reached out for comment from Algorythm Holdings to no avail, as the company did not respond to the request for comment.

The white paper campaign and the Fox News segment increased attention to the ticker and unsustainable, inorganic demand in the trading of RIME as of after-hours trading on Friday, 2/13/26.

Inside the Numbers

The company’s financial distress is no stranger to either shareholders or insiders, as they hold no stake in the company, and worsening numbers keep appearing on the horizon for each passing quarter. For the nine months ended September 30, 2025, revenue totaled $3.0 million, but the cost of sales exceeded revenue, resulting in a gross loss.

Source: RIME Form 10-Q quarterly period ended September 30, 2025

Operating cash flow was negative $8.56 million on December 31, 2024, and negative $4.34 million for the first nine months of 2025, while cash declined from $7.55 million on December 31, 2024, to $2.84 million on September 30, 2025.

Stockholders’ equity was a $10.5 million deficit at December 31, 2024, and the 10-K disclosed substantial doubt about the company’s ability to continue as a going concern without additional financing. In that environment, instruments like the Streeterville facility sit at the center of the funding model rather than on the margins.

Source: RIME Form 10-K year ended December 31, 2024,

Source: RIME Form 10-Q quarterly period ended September 30, 2025

Taken together, the pattern is straightforward, and it clearly appears that the business is not funding itself. Cash has been consumed, we see thin equity, and outside capital has filled the gap. In that context, the Streeterville facility is not a side note. Rather, it sits at the center of how the company finances its operations.

The Streeterville Toxic Lending Facility

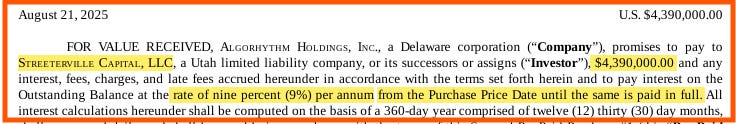

On August 21, 2025, RIME entered into a Securities Purchase Agreement with Streeterville Capital, LLC. The agreement was disclosed in a Form 8-K filed August 27, 2025; the headline number was $20 million. That figure represents the aggregate capacity available under one or more “Pre-Paid Purchases” over a two-year commitment period.

The initial tranche was smaller. The company issued a secured pre-paid purchase in the principal amount of $4,390,000. After a 9% original issue discount and transaction expenses, net proceeds totaled approximately $3,565,000. In addition, 95,694 shares were issued as commitment shares to the investor.

Source: Form 8-K, Aug 27, 2025

The balance accrues interest at 9% per annum and matures three years from issuance. The obligation is secured by all company assets and guaranteed by operating subsidiaries pursuant to a Security Agreement and Guarantee executed at closing.

The conversion mechanism is defined by a formula. Following funding of a Pre-Paid Purchase, the investor has the right to require the company to issue shares of common stock equal in value to the outstanding balance of the funded amount. The purchase price of those shares is set at 90% of the lowest daily volume-weighted average price during the ten trading days immediately preceding the purchase notice date, subject to a stated floor price.

The agreement includes a 9.99% beneficial ownership limitation. At no time may the investor beneficially own more than 9.99% of the company’s outstanding common stock. The cap governs ownership at a moment in time. It does not terminate the facility.

The settlement pathway is described directly in the filing. Upon delivery of a purchase notice, shares are issued. The investor may sell those shares, and the proceeds are applied to reduce the outstanding balance of the Pre-Paid Purchase.

In November 2025, a second Pre-Paid Purchase was executed. The stated principal was $5,450,000 before original issue discount. Of the $5,000,000 received, $4,500,000 was placed into a controlled account pursuant to a Deposit Account Control Agreement among a wholly owned subsidiary, Lakeside Bank, and Streeterville Capital.

The terms are set out in the 8-K and subsequent 10-Q filings. Pricing references recent trading data. Ownership is capped at a point in time. Issuance volume is linked to outstanding balance and available share capacity.

Source: Form 8-K, Aug 27, 2025 - Securities Purchase Agreement (Item 1.01)

Share Expansion & Dilution Bridge

The agreement was executed in late August 2025, and over the following weeks, the share count began to reflect its presence. By November 17, 2025, outstanding shares stood at roughly 2.7 million. Two months later, on January 21, 2026, that number had risen to approximately 5.76 million, an increase of about 3 million shares in roughly sixty days.

Source: Form 8-K, January 21, 2026

The share count increase between mid-November and late January coincides with the period when the second Pre-Paid Purchase became effective, and resale registration was available.

Between November 2025 and January 2026, outstanding shares expanded by more than 100%. The instrument in place during that period priced issuance at a discount to recent VWAP and permitted repeated issuance subject to a point-in-time ownership cap.

That is the bridge between agreement and share count.

The Streeterville Pattern

Just like every purchase agreement has two sides, a company seeking capital and a counterparty willing to provide it, the August 2025 lending facility at RIME has its own structure of participants, as well.

On one side sits RIME, a company with limited operating cash flow and a need for external financing, but who was sitting on the other side of the table?

That is where John M. Fife enters the picture.

John M. Fife is a Brigham Young and Harvard-educated computer scientist. He is also the founder and managing partner of Chicago Venture Partners, a private equity and hedge fund that invests primarily in small-cap companies. He also controls other investment companies, among them is Streeterville Capital LLC. Despite a 2020 SEC Complaint and lawsuit alleging that Fife was involved in a multi-year toxic financing and pump-and-dump scheme spanning 135 companies, $61 million in profits, and 21 billion shares issued, the SEC dismissed the case with prejudice in June 2025.

Source: United States Securities and Exchange Commission vs. John M. Fife:

Fife is well known for leveraging his computer science education and background to run sophisticated algorithms that move stock prices upward.

He also owns Emergent Trading, which describes itself as developing “high-frequency, fully-automated, international exchange-based trading systems.” This structure allows him to deploy high-volume share disposals to maximize profits and minimize market impact.

The SEC named Fife in that action alongside Chicago Venture Partners, Iliad Research and Trading, St. George Investments, Tonaquint, and Typenex. The Commission’s complaint described a repeatable structure built around microcap convertible-style paper, discounted share issuances, and the resale of the resulting shares into the public market.

Source: Securities and Exchange Commission v. John M. Fife

On June 18, 2025, the SEC filed a joint stipulation dismissing the Fife action with prejudice, and later published a release announcing the dismissal.

Source: United States Securities and Exchange Commission vs. John M. Fife:

The SEC’s pleadings put names and mechanics to a model that has repeatedly surfaced in microcap financings.

Resale Plumbing

Streeterville’s economics are built into Algorhythm’s S-1 registration. Amendment No. 1 to Form S-1, filed in October 2025, adds a resale prospectus that reserves 10,095,694 shares of common stock for Streeterville Capital, LLC. That block consists of 95,694 commitment shares issued at closing and up to 10,000,000 purchase shares that may be issued under the August 21, 2025, Securities Purchase Agreement. The same filing shows 2,641,778 common shares outstanding before the Streeterville facility and a pro forma 12,641,778 shares if all purchase shares are issued, which means the Streeterville line alone contemplates a share count several times larger than the pre-deal base.

The document also clarifies how money and stock move. The resale section states that Algorhythm will receive no proceeds from Streeterville’s sale of these shares, while the selling stockholder pays its own commissions and discounts, and the company covers registration costs. A separate distribution plan paragraph gives Streeterville the ability to sell its registered stock from time to time through ordinary broker transactions, block trades, privately negotiated sales, or sales to dealers for resale, and notes that Streeterville and participating brokers may be treated as underwriters for these transactions. A selling stockholder table then links the numbers to the contract terms, listing Streeterville’s 10,095,694 registered shares and repeating the 9.99% beneficial ownership cap,

The Fake “AI” Indian Narrative

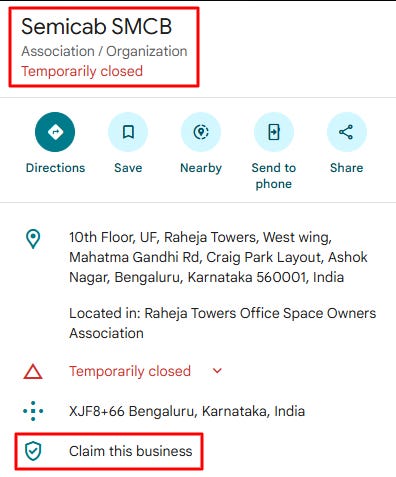

The majority of RIME’s revenue comes from its Indian subsidiary, called SemiCab, a company that brags about AI freight integration despite having third-world, outdated vehicles, which are pictured in the company’s white paper sources.

SemiCab is registered in Bangalore, India, and as a foreign registered company, it lacks the desired oversight, transparency, and access to financial information and disclosures in order to really see the true picture of the business, the source of its revenue, capital expenditure, and, most importantly, its balance sheet.

The company’s January 2026 SemiCab release discusses a roughly $9.7 million annualized revenue run rate, which, as previously mentioned, is unverified and publicly inaccessible.

Despite bold claims of technological innovation and AI integration, SemiCab operates with outdated and conventional trucks with no verifiable evidence of meaningful AI integration or proprietary technology. Adding to investor concern, the headquarters reflect a company far from the “Industry disruptor” label it has claimed for itself, as its Google Business profile is even marked as temporarily closed. It’s not even verified, and anyone with a Google account can claim the business as their own.

Above: The company’s headquarters is located on the 10th floor of the Raheja Towers in Bangalore, India. A corporate space worthy of an “Industry Disruptor”.

Conclusion

Algorhythm is not a misunderstood AI logistics innovator; it is a legacy cash-burning microcap that pivoted from karaoke machines to chase a hyped-up AI narrative while financing operations through discounted equity conversion that mechanically erodes shareholder value. Reported revenue remains minimal, gross margins are negative, operating cash flow continues to deteriorate, and management itself discloses substantial doubt about the company’s ability to continue as a negative going concern. The business has not demonstrated a viable, self-funding model since abandoning its karaoke hardware roots.

The company’s survival now hinges on the Streeterville pre-paid purchase facility, which is structurally designed to translate declining market prices into accelerating share issuance. The consequences are already visible. Outstanding shares more than doubled in roughly two months as the facility became active. This is not speculative downside risk; it is authorized, disclosed, and embedded in the financing mechanics.

Meanwhile, the India-based “AI freight” narrative, white papers, and a brief television appearance have provided promotional oxygen and trading liquidity without altering the economic reality reflected in the financials. Until meaningful, audited revenue replaces operating losses, the capital structure will continue to dictate outcomes. In practical terms, Algorhythm (RIME) remains a dilution-funded shell wrapped in an AI narrative. RIME is structurally incentivized to issue more shares as prices fall, leaving John Fife as the only one to benefit from the money play, with shareholders providing the liquidity for the exit. This is not an AI turnaround story; it is a dilution machine with a ticker symbol.

Disclaimer

The research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.

Another compelling report. Thanks Fugazi.