$OPTX: Zooming in on a Capone Style De-SPAC Where the Boss Cashes in and Takes All

One Insider & Total Economic Control

Fugazi Research Analysis

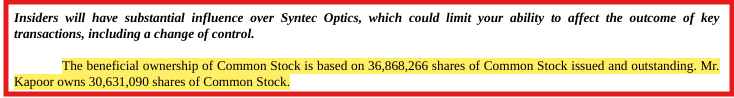

Al Kapoor simultaneously served as CEO of the private company (Syntec Optics) and the SPAC sponsor (Omnilit Acquisition Corp.), which merged into OPTX (Syntec Optic Holdings), creating a structure in which he emerged with control of 80+% of the company’s outstanding shares.

OPTX de-SPAC’s structure provides Kapoor with an asymmetrical upside for a single insider, who, in this case, is only him, creating a big opportunity to cash out now that he has access to equity markets.

Operating cash flow was driven mostly by new borrowing, not profitability, as the company still reported a $1.45 million net loss and relied on $500,000 of fresh debt to fund capex.

The company is effectively overleveraged, as cash flows are not enough to cover interest and capital obligations without new borrowing. This leaves the balance sheet net negative and dependent upon continued access to external capital.

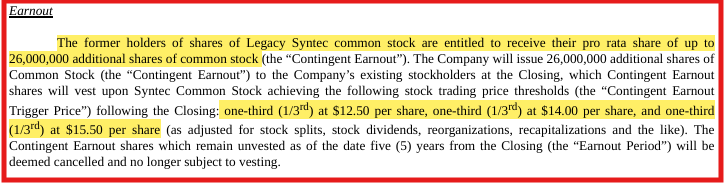

Hidden dilution remains a risk, as Al Kapoor can obtain 21 million additional shares if the price hits a threshold, driving him towards stock price engineering and manipulation. All of these details were stated in the merger registration.

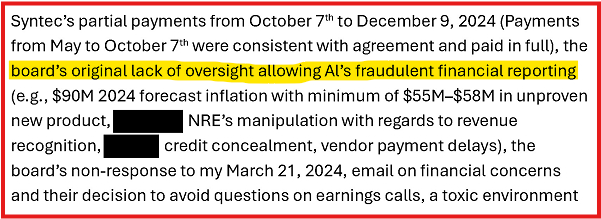

Past governance failures were reported by one of the board members (who also served as OPTX’s CEO for a brief tenure) to a corporate lawyer. Additionally, a second email with these glaring concerns was sent directly to the CFO, expressing his concern about “lack of oversight allowing Al Kapoor’s fraudulent financial reporting” and Al Kapoor’s “continuous pattern to avoid any questions during earnings calls”. This board member was forced to resign after refusing to sign the 2024 10-K due to serious financial concerns.

Multiple Nasdaq Non-compliance notices since the company’s inception highlight constant failures to meet minimum listing standards & good financial practices, thus increasing the risk of delisting.

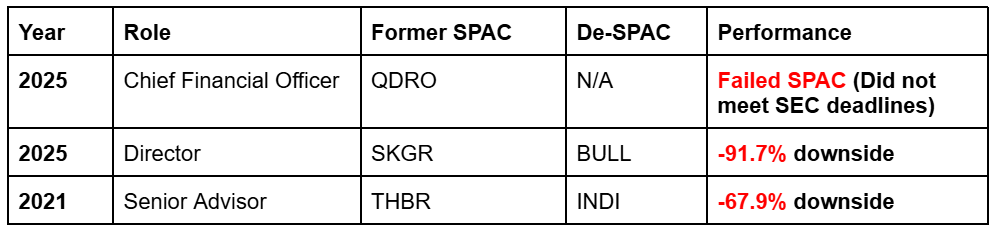

Some members of the OPTX Board of Directors raise serious governance and business quality concerns. These include a director whose career is largely defined by repeated blank-check companies, and another director with a casino and entertainment background who served as the CEO of a public company from its IPO through its eventual demise and private equity acquisition. This was followed by a period of intensive shareholder litigation after the company’s demise.

We consider that the company’s current financial situation, along with its negative cash flow and negative net liquidation value at current rates, makes the shares uninvestable and worthless.

OPTX Financial Summary

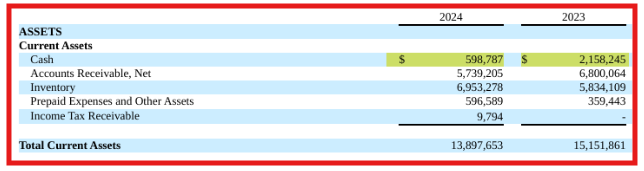

Cash plummeted from $2.2 million (10-K, 2023) to $600,000 (10-K, 2024), a 72% decline.

Negative Operating Cash flow of -$900,000 (10-K, 2024), compared to $2.8 million (10-K, 2023), a $3.7 million difference, indicating financial distress.

Only $3.8 million is available on an $8 million line of credit, which shows that the available cash and current line of credit are insufficient to maintain operations.

The bank reduced the existing credit line from $10 million to $8 million due to a breach of the maximum leverage ratio, requiring two waivers from the lender in November 2024 and March 2025.

The leverage ratio was allowed to increase to 5.25x, indicating that it would take the company 5 years of current operating cash flow to pay its current debt.

Sales down 3.4% year over year, from $29.4 million to $28.4 million.

Net income crashed from $1.5 million (10-K, 2023) to a net loss of -$2.6 million (10-K, 2024), a 225% collapse.

Three customers account for 47% of revenue and 54% of accounts receivable.

Source: OPTX Form 10-K year ended December 31, 2024

Executive Summary

Syntec Optics Holdings, Inc. entered the public markets in late 2023 through a de-SPAC transaction with OmniLit Acquisition Corp., converting a long-operating, privately controlled manufacturer into a publicly traded equity. The transaction preserved concentrated control and embedded it within a capital structure characterized by staged liquidity, conditional dilution, and price-linked incentives.

At the center of the structure is Al Kapoor, the CEO and controlling shareholder, who holds more than 80% of the outstanding equity. This concentration qualifies the company as a controlled issuer under Nasdaq rules. The SPAC sponsor was also controlled by the same individual who now serves as Chairman and Chief Executive Officer, reflecting continuity of authority rather than a transition to independent public-market governance.

While the underlying operating business is real and longstanding, the public equity wrapper relies on constrained float and deferred monetization. Although approximately 37 million shares are outstanding, affiliate ownership leaves only a limited portion available for trading. Behind that trading supply sits substantial contingent dilution, including a ~26 million-share earnout tied solely to stock-price thresholds and allocated primarily to insiders. Additional dilution is staged behind warrants and registration constraints.

The resulting dynamic is structural: insiders can benefit from price appreciation while a limited float concentrates trading activity. Earnouts can vest, warrants can become more valuable, and dilution can be deferred until contractual or regulatory gates are met.

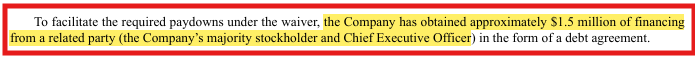

The balance sheet reinforces these incentives. Following the de-SPAC transaction, the company disclosed covenant breaches under its revolving credit facility and relied on waivers and amendments rather than a market recapitalization. During this period, liquidity was supplemented through insider financing from Kapoor, further concentrating control, financing, and decision-making during a period of financial stress.

At the same time, the company’s narrative emphasizes exposure to defense, aerospace, and advanced imaging markets. Syntec has announced orders tied to U.S. military augmented-reality initiatives; however, the disclosed scope and financial contribution of those awards appear limited and are not consistently quantified across filings and communications.

Taken together, these elements describe a recognizable configuration: concentrated ownership, constrained trading supply, staged dilution, insider financing during balance-sheet pressure, and narrative positioning in end-markets that lend themselves to forward-looking framing. This report does not assess product legitimacy; it evaluates the public equity structure and how incentives, liquidity timing, and market behavior interact.

The Playbook

Venture Capital Creation

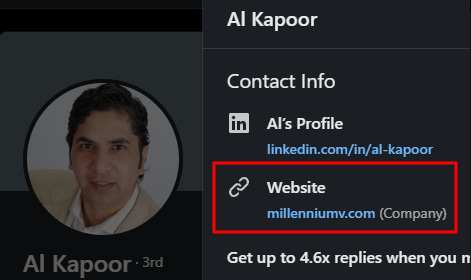

Kapoor previously owned Millennium Pioneer Ventures, an investment firm that invested in or acquired companies. Public records indicate the entity is no longer active and is registered as closed. The firm was based in Waltham, Massachusetts, and its website appears inactive.

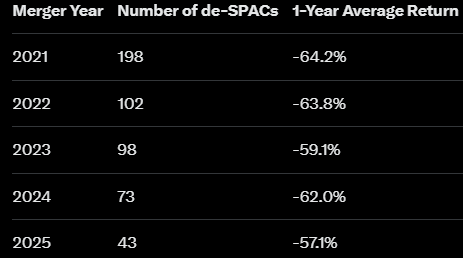

Public companies formed through de-SPAC transactions often position themselves as newly capitalized growth platforms. The surface narrative emphasizes access to public capital, accelerated expansion, and a transition from private constraint to public scale. In practice, a subset of these transactions preserves control and stages liquidity, aligning insider economics more closely with stock price behavior than operating cash generation.

Syntec Optics aligns with several of those characteristics.

In a traditional IPO, dilution is generally front-loaded: shares are sold, float expands immediately, and insiders begin a gradual exit subject to lockups. In many de-SPACs, dilution is back-loaded. Large volumes of equity are withheld from the market and tied to contingencies, keeping the effective float constrained even when shares outstanding appear large on paper. This can increase price sensitivity to modest trading volume and can make price-linked incentives more consequential.

Syntec’s merger agreement reflects this logic. The earnout introduces up to ~26 million contingent shares, with a substantial portion allocated to legacy holders (including the controlling shareholder). These shares do not trade until defined price thresholds are met over specified measurement periods. Importantly, those thresholds are tied to trading prices rather than operating benchmarks such as revenue, margins, or cash flow.

Control matters because it affects coordination and timing. With more than 80% beneficial ownership held by affiliates of a single individual, the company operates as a controlled company under Nasdaq rules, reducing certain independence requirements and limiting minority-shareholder governance influence. In this configuration, public shareholders primarily participate through trading rather than voting.

Narrative can become functionally important in such structures. Markets like defense, aerospace, and advanced manufacturing naturally lend themselves to long timelines and incremental progress disclosures (prototypes, customer engagements, certifications) that may not immediately translate into revenue recognition. The filings acknowledge real operations while also describing customer concentration, limited visibility, and reliance on covenant management. These realities can coexist in a capital structure where price plays an outsized role in determining when contingent mechanisms activate.

Under financial stress, the source of liquidity becomes informative. When operating cash flow and external credit tighten, insiders in tightly controlled structures can become liquidity providers. Syntec’s disclosures indicate that during covenant pressure and reduced borrowing capacity, related-party debt supported liquidity needs. In effect, control and capital converged further during the period of greatest constraint.

The sections that follow move from the framework to specific disclosures on governance, compliance history, customer concentration, and capital structure. The aim is not to predict outcomes but to clarify mechanics. Once those mechanics are understood, observed market behavior becomes easier to interpret.

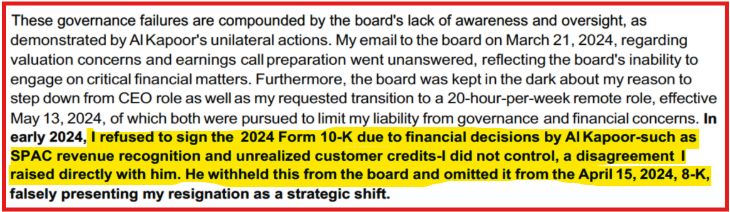

The Insider Emails

In March 2025, former CEO and board director Joseph Mohr described significant governance concerns in emails included as SEC exhibits. In his resignation letter to the board and to Dean Rudy (now CFO), Mohr cited “significant governance concerns” that he stated had persisted since before the company became public in November 2023. He also stated that he refused to sign the 2024 Form 10-K, citing disagreements regarding financial decisions, including revenue recognition and unrealized customer credits.

Source: SEC OPTX Exhibit 99.1

In a separate email to corporate counsel Christopher Rodi, Mohr expanded on these concerns and alleged deficiencies in oversight. He referenced issues including forecasting practices, revenue recognition, customer credits, vendor timing, and board responsiveness to questions and concerns. In fact, no questions were answered during earnings calls.

Source: SEC OPTX Exhibit 99.2

A former CEO and sitting board director refusing to sign the 10-K and alleging serious reporting and oversight issues constitutes a material governance signal for investors. The claims also raise questions about internal controls, board independence, and disclosure discipline.

The History of Non-Compliance

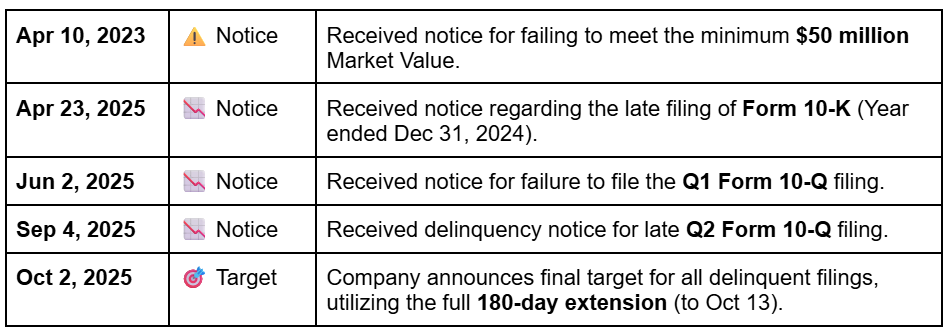

OPTX has received multiple Nasdaq deficiency notices and disclosure-related notices since becoming public. Between 2023 and 2025, the company received notices related to late periodic filings (10-Q/10-K) and, at times, minimum market-value thresholds.

Rather than isolated incidents, the notices appear to reflect repeated delays and compliance remediation driven by extensions. For public shareholders, timeliness matters because periodic filings are foundational to transparency. Repeated failures can undermine confidence in internal controls and management credibility.

The company received an extension through October 2025, which it utilized fully, and the period coincided with disclosed governance conflict and board turnover.

Key dates (per 8-Ks):

Source: OPTX form 8-K April 10, 2024

Source: OPTX form 8-K September 4, 2025

Source: OPTX form 8-K April 23, 2025

Source: OPTX form 8-K June 2, 2025

Source: OPTX form 8-K October 2, 2025

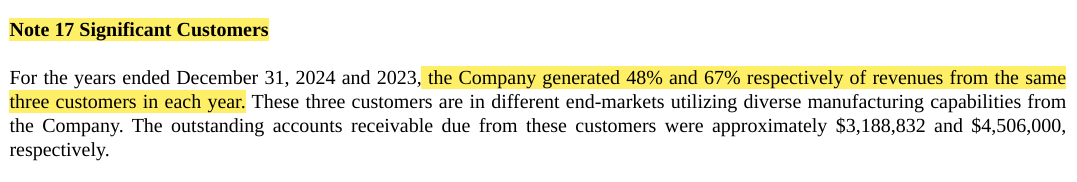

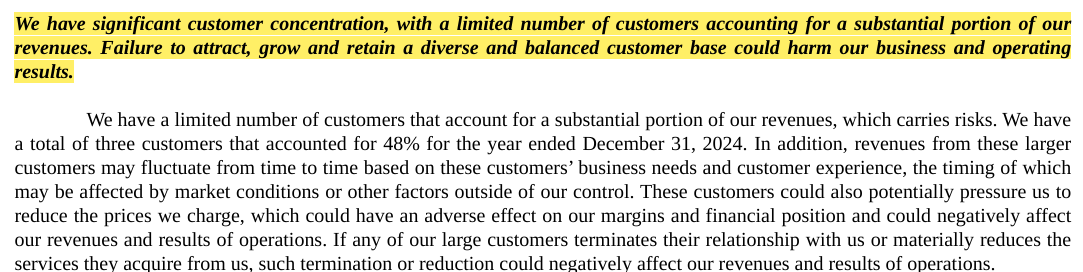

Customer Concentration Risk

Customer concentration remains a material business risk. In the latest fiscal year, three customers accounted for ~48% of revenue (vs. ~67% in 2023). Accounts receivable from these customers were ~$3.2 million (down from ~$4.5 million), indicating meaningful reliance on timely payment behavior from a small customer set.

The company’s risk disclosures acknowledge that the loss of one or more of these customers could materially harm operations and revenue.

Source: OPTX Form 10-K year ended December 21, 2024

The company’s own risk disclosures acknowledge that if any of these customers terminate their relationship, it could severely harm operations and affect revenue.

Source: OPTX Form 10-K year ended December 21, 2024

Board Background Risk

Certain board backgrounds raise governance-quality questions relevant to public shareholders, particularly in a controlled-company context where minority governance leverage is limited.

Walter Bishop, described as a financial services executive, has been associated with multiple SPAC-related roles. Several referenced de-SPAC outcomes have experienced substantial post-combination underperformance or failed to complete compliance milestones.

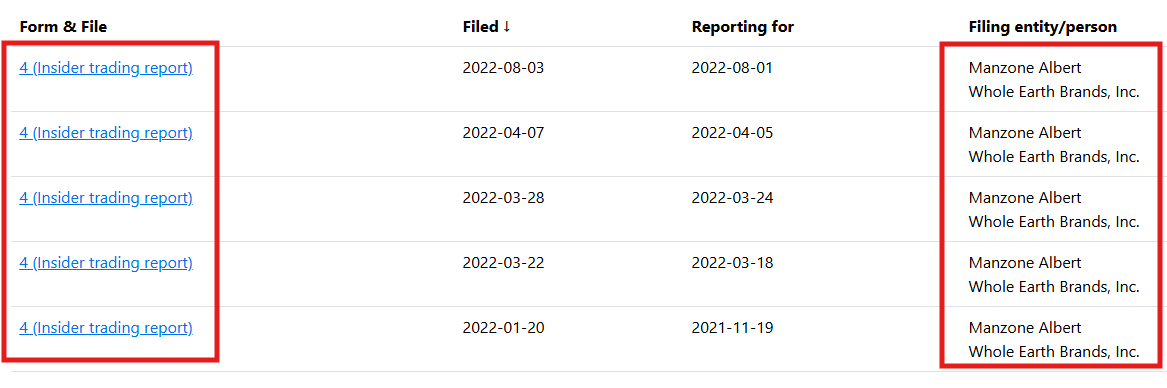

Albert Manzone, with a casino/entertainment background, previously served as CEO and director of Whole Earth Brands through a SPAC transition and later through a take-private transaction. Shareholder litigation followed the company’s decline and acquisition.

According to public records, this period is marked by Manzone’s direction and leadership from the company’s Nasdaq listing, which began as a blank-check company named Act II Global Acquisition Corp, based in the Cayman Islands, and culminated in its De-SPAC as Whole Earth Brands on June 24, 2020. Going from a high of $13.85 per share (June 24, 2020), until its imminent collapse and private equity acquisition at $4.875 (August 2, 2024). This triggered a wave of litigation against the company and its directors by several law firms on behalf of shareholders. Also worth noting is that he quietly disposed of his company shares in 2022, when stock prices were still favorable.

Source: SEC EDGAR Database Form 4

For investors, these histories matter because they may inform expectations regarding governance rigor, disclosure discipline, and alignment between insiders and minority shareholders.

Scale vs. Financial Capacity

Syntec Optics presents itself as a specialized manufacturer operating in the defense, aerospace, and advanced imaging industries. The company highlights participation in industry exhibitions, the development of new optical assemblies, and engagement with customers whose end markets entail high manufacturing costs and significant technical barriers.

What matters is not whether the business exists, but whether the scale implied by the narrative is supported by the financial statements disclosed in the filings.

Above: The company’s flagship products reflecting their “300 million” market cap and industry leadership.

The company’s own risk disclosures provide a first glimpse into the company’s structural vulnerability. As we mentioned before, customer concentration, debt accumulation, and the fact that the company does not disclose long-term contracts, program-of-record designations, or backlog to sustain continued operations.

Source: OPTX Form 10-K year ended December 21, 2024

This disclosure is not unusual for a niche manufacturer. What is notable is how it sits alongside the broader positioning. Defense and aerospace narratives often imply durability, multi-year visibility, and institutional demand. In Syntec’s case, the filings describe exposure to those end markets without the contractual or backlog disclosures that typically accompany them.

Liquidity constraints reinforce this disconnect. Following the de-SPAC transaction, Syntec disclosed breaches of financial covenants under its revolving credit facility. The company required multiple waivers and amendments to remain in compliance. Rather than expanding borrowing capacity to fund growth or working capital, the amendments reduced flexibility and imposed tighter terms.

Source: OPTX Form 10-K year ended December 21, 2024

During this period, Syntec supplemented liquidity through debt financing from a related party, namely its majority stockholder and Chief Executive Officer, Al Kapoor. Approximately $1.5 million of insider liquidity and financing was disclosed as debt and used to satisfy obligations under amended credit terms. This financing did not represent growth capital. It functioned as a bridge to maintain lender compliance.

Source: OPTX Form 10-Q September 30, 2025

These disclosures matter because they describe a net negative operating company that is not deploying excess capital into expansion. It is managing debt, preserving access to a constrained revolver, and relying on insider support during continuous periods of stress.

At the same time, the capital structure introduces incentive mechanisms that reward stock price performance independently of operating cash generation. The merger agreement explicitly allows the release of 26 million shares as “contingent earnout shares”, in case certain price thresholds are met. However, these shares are not to be released to the public float but rather remain as majority-controlled shares (Kapoor would receive around 21.6 million shares) under the merger agreement. Providing him with a strong incentive for price engineering and stock walking up in order to have the ability to cash out.

Source: OPTX Form 10-K year ended December 21, 2024

The company just turned Income to a net loss in the span of one year.

Source: OPTX Form 10-K year ended December 21, 2024

Year over year, cash reserves have declined; however, they remain positive only through borrowing.

Source: OPTX Form 10-K year ended December 21, 2024

The illusion of scale comes not from falsehood but from leaving out important context. When narrative positioning is considered without the balance sheet, it suggests stability and growth. When the balance sheet is viewed alongside the narrative, it shows a company operating under tight financial limits while holding significant, price-linked equity incentives.

This distinction is critical for understanding market behavior. In a structure where effective float is limited and large volumes of equity sit behind contingent triggers, incremental visibility can move the price even if underlying cash flows remain unchanged. Public shareholders trade what is available. Insiders wait for what is not.

Control Before Listing

Control at Syntec did not result from the public listing; it preceded it. The de-SPAC transaction formalized an existing concentration of authority rather than diluting it.

As disclosed in the company’s proxy materials, affiliates of a single individual beneficially own more than 80% of outstanding shares—sufficient to control shareholder votes, elect directors, and approve major corporate actions without reliance on minority holders. The company elects controlled-company exemptions under Nasdaq governance rules.

Source: OPTX Form 10-K year ended December 21, 2024

The merger filings also disclose that the SPAC sponsor was controlled by the same individual who later assumed the CEO and Chairman roles post-close. Subsequent management transitions further reflect consolidation: sponsor-aligned leadership assumed the CEO role, and the prior CEO later resigned from the board following disclosed disagreements regarding operations, policies, and practices.

None of this requires allegations of misconduct. It describes a governance system: ownership, authority, and decision-making are unified.

When the Balance Sheet Speaks

Balance-sheet stress often reveals how a controlled structure functions in practice. Syntec disclosed covenant breaches under its revolving credit facility during FY 2024 and required lender consent to avoid default and preserve access.

The company’s response was not a recapitalization or an expansion of credit capacity; it was a series of waivers and amendments. These amendments provided temporary relief while reducing borrowing availability and tightening terms, narrowing flexibility rather than restoring it.

During this period, liquidity support was supplemented through related-party debt from the controlling shareholder. This is structurally significant: when credit tightened, the company leaned inward rather than outward. Equity holders, executive authority, and liquidity provider roles converged in a single insider during a period of constraint.

The filings also disclose historical related-party arrangements (including prior management fees) that underscore the financial interdependence between the operating company and its controlling owner.

Individually, these disclosures do not prove wrongdoing. Collectively, they describe an enterprise in which the controlling shareholder occupies multiple roles: majority owner, executive decision-maker, and liquidity backstop.

Conclusion

Syntec entered the public markets with a real operating business and a longstanding private-market history. The transition to a publicly traded entity did not materially alter who controls the business; it did, however, alter how control is expressed within a public equity framework.

The de-SPAC transaction formalized a structure defined by concentrated ownership, constrained float, staged dilution, and price-linked incentives. In such a configuration, market pricing can be influenced by float scarcity and the timing of contingent mechanisms as much as by operating performance. When the balance sheet tightened, the company relied on waivers, amendments, and insider liquidity rather than a broad market recapitalization, reinforcing the convergence of control and capital during stress.

Syntec has announced orders tied to U.S. defense initiatives, indicating some traction in mission-critical end markets. However, the scope and financial contribution of those awards are not consistently quantified in public disclosures, limiting visibility into how materially they change near-term cash generation.

Taken together, these disclosures describe a public equity structure that emphasizes timing and control: concentrated ownership, constrained float, staged dilution, and price-linked incentives, reinforced by insider liquidity during periods of balance-sheet pressure. Recent share price gains reflect constrained float dynamics and incentive-driven mechanics more than underlying business performance, leaving current valuation increasingly disconnected and ultimately unjustified.

Disclaimer

The research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.

Nice job Fugazi. What a terrific read, and an even better short. You guys are on fire! The new Hindenburg Research!!!