Davis Commodities $DTCK: When the Sweet Trade Turns Rotten

A Family Run Illusion in the Global Commodities Game

Executive Summary

Davis Commodities Ltd. (NASDAQ: $DTCK) is a Singapore-based agricultural-commodity trader that listed on Nasdaq in 2023, presenting itself as an “asset-light, high-growth exporter” of sugar, rice, and oils across Asia, Africa, and the Middle East.

Our investigation finds that Davis Commodities has evolved from a modest regional trader business into a capital-markets mirage. A family-controlled vehicle recycling cash through affiliates, engineering hype cycles, and positioning for dilution through repeated narrative pivots.

Key findings include:

From Exporter to Mirage: Revenue and margins have collapsed, yet management continues to present a picture of expansion and modernization. The gap between filings and rhetoric is widening fast.

Family-Controlled & Self-Financed: A small circle of insiders dominates governance, extends loans to affiliates, and leases core facilities to themselves. This structure keeps cash circulating inside, not out.

Auditor Turnover Under Pressure: After internal-control weaknesses were disclosed, the auditor was replaced with a smaller firm: a common prelude to accounting opacity.

Narrative Engineering Replaces Growth: In the past year the company has pivoted from commodity trade to tokenized ESG corridors, crypto-style initiatives, and consumer-goods dreams, each timed around market stress or financing capacity.

Press-to-Raise Pattern: As fundamentals eroded, management secured a new shelf registration and paired it with aggressive promotional releases. The hallmark sequence of a microcap preparing to issue more shares.

The Fugazi View:

Davis Commodities is not scaling a business; it’s maintaining an illusion. The pattern of insider control, circular finance, and narrative inflation points to a structural deception designed for capital-markets extraction rather than trade-driven profit.

1. The Davis Playbook: How to Turn a Trading Firm into a Stock Mirage

The Struggling Trader

A low-margin commodities broker with declining volumes and vanishing cash faces an existential problem: it can’t fund working capital or attract investors.

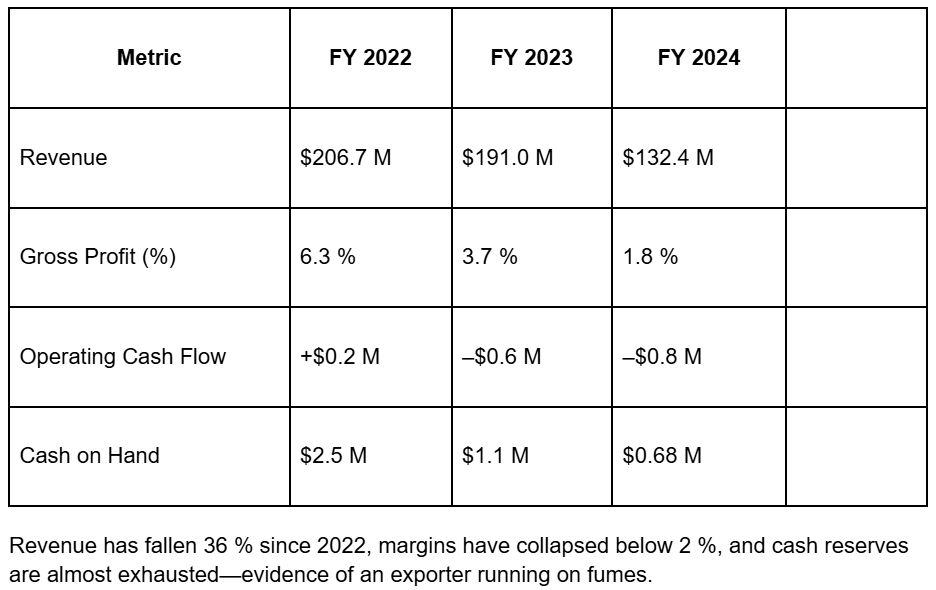

$DTCK’s audited numbers show an exporter running on fumes, margins under 2%, negative cash flow, and less than $1 million in the bank.

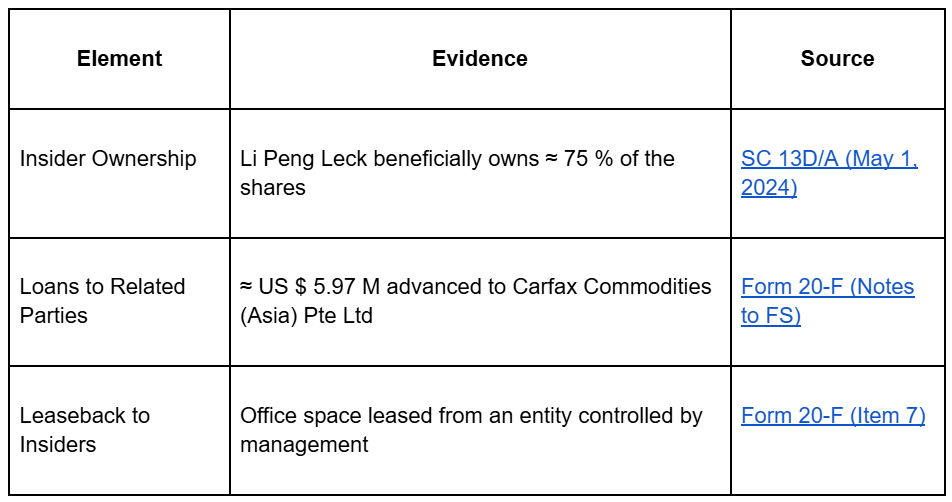

The Governance Shield

With one family controlling 70 – 75 % of the vote, every decision (loans, leases, disclosures) stays in friendly hands.

No independent directors to object, no audit committee with teeth, and a “controlled-company” exemption that keeps regulators at bay.

This insulation lets insiders operate the balance sheet like a private checkbook.

The Circular Cash Loop

When liquidity tightens, Davis “lends” millions to an affiliate: Carfax Commodities (Asia), and later announces plans to acquire that same entity.

The same money leaves and returns under a new label, magically creating the illusion of expansion.

In the filings, the transaction appears as both “investment” and “growth initiative,” masking what is effectively self-financing.

The Auditor Swap

After admitting control weaknesses, management quietly replaces its auditor with a smaller, lower-visibility firm.

Nothing changes in the numbers, only the scrutiny level.

This is the microcap version of switching referees mid-game.

The Narrative Pivot

With fundamentals crumbling, Davis discovers a new identity:

First, an ESG tokenized yield corridor supposedly worth $1 billion, then a FMCG expansion into consumer products.

Neither venture produced contracts, assets, or revenue.

But they generated what mattered: attention.

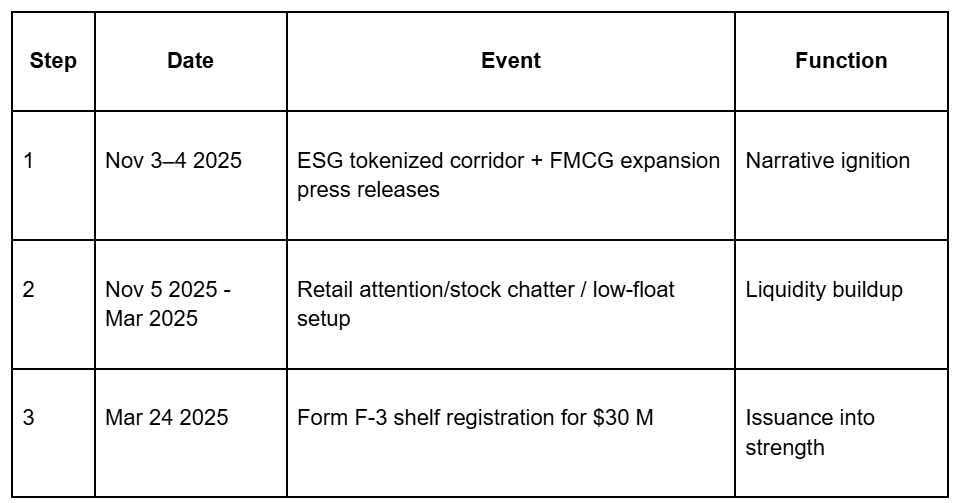

The Press-to-Raise Cycle

Immediately after the pivots, management files a $30 million shelf registration, enabling rapid stock issuance.

The sequence is textbook: announce a futuristic project → trigger retail interest → issue shares into strength.

This is not growth; it’s narrative-driven liquidity engineering.

The Market Reaction

Each announcement sparked temporary trading spikes and online chatter, exactly the outcome management needed to reprice the stock and keep it Nasdaq-compliant.

The market believes the headline; insiders monetize the volume.

The Perfect Illusion

To an uninformed investor, Davis looks like a diversified agriculture, fintech, ESG, crypto, and consumer goods.

To those reading the filings, it’s a single-purpose shell keeping itself alive through storylines and share issuance.

It’s not running a trade network; it’s running a narrative loop.

The Bottom Line

Davis Commodities’ supposed transformation from exporter to “digital-ESG innovator” is not a strategy. It’s just a survival mechanism.

The company isn’t building value in sugar, rice, or oil.

It’s refining the one product that truly matters in the microcap market: belief.

2. Inside the Numbers

From Exporter to Mirage

Davis Commodities’ financials reveal a collapsing core business behind its growth narrative.

Family-Controlled & Self-Financed

A small circle of insiders dominates governance and controls cash flow.

The money never leaves the family.

Every loan, lease, or advance flows through a closed circuit of related parties, then reappears under a different name.

On paper, it looks like “growth financing.” In reality, it’s just cash revolving through the same small circle, a liquidity treadmill disguised as expansion.

This isn’t corporate governance. It’s dynastic control.

A single family acts as lender, landlord, and shareholder, deciding who gets paid and when.

For minority investors, this isn’t participation—it’s donation.

Their capital keeps the loop alive, not the business.

Auditor Turnover Under Pressure

When Davis began disclosing “material weaknesses” in internal controls, investors expected a cleanup.

Instead, the company changed referees mid-game.

The FY 2024 annual filing reveals that Onestop Assurance PAC, the auditor responsible for exposing those control gaps, was quietly replaced with AOGB Audit PAC, a smaller, lower-visibility firm known for signing off on thinly-capitalized micro-issuers across Singapore.

No explanation, no audit-committee statement, no independent review.

It’s the classic microcap sleight of hand: when scrutiny tightens, downgrade the scrutiny.

Numbers stay the same; the questions disappear.

Narrative Engineering Replaces Growth

By late 2025, the trading business had nothing left to sell—except stories.

On November 3, management unveiled a “$1 billion ESG-Tokenized Yield Corridor” linking Asia, Africa, and Latin America.

A day later, a second headline appeared: a bold leap into “FMCG expansion and consumer-goods innovation.”

No assets, contracts, or partnerships accompanied either announcement.

But the market didn’t care. Headlines were enough. Retail volume exploded; forums buzzed.

The once-invisible rice trader was suddenly a “digital-ESG innovator.”

This is how you turn declining fundamentals into fuel for speculation—by turning filings into fiction.

The Press-to-Raise Cycle

Weeks after those futuristic press releases, Davis filed a Form F-3 shelf registration to sell up to US $30 million in new securities.

The timing wasn’t a coincidence; it was choreography.

Announce a billion-dollar vision.

Watch volume surge and the stock reprice.

File the shelf and prepare to issue into strength.

That is liquidity engineering, not growth.

The shelf itself reads like a blueprint for monetizing belief:“From time to time, we may offer, issue and sell up to US$30,000,000 of any combination of the securities described in this prospectus in one or more offerings..”

— Form F-3, March 24 2025The Market Reaction

Every pivot delivered the same pattern—short bursts of euphoria followed by silence.

When the ESG corridor announcement hit the wire, trading volume quadrupled, and shares jumped roughly 45 % intraday.

The next day’s FMCG expansion produced an even larger spike, volume up six-fold, price up over 60 %.

By week’s end, the gains were gone.These weren’t investors rediscovering value; they were traders chasing momentum.

The company needed that frenzy to stay above Nasdaq’s $1 minimum bid price, and it worked, temporarily.The Perfect Illusion

From the outside, Davis looks like a diversified multinational: commodities, ESG, crypto, fintech, consumer goods.

Inside the filings, it’s still a thin-margin broker moving bulk rice and sugar through Singapore warehouses, its cash flow is negative, its auditor downgraded, and its survival is tied to the next headline.What Davis actually trades isn’t sugar or oil—it trades belief.

The commodity is narrative, and the market keeps buying it.

ConclusionDavis Commodities has mastered the art of looking busy while going nowhere.

Cash moves in circles, auditors rotate, and new narratives appear every time the numbers run out.

It’s motion without progress, the illusion of growth masking financial exhaustion.When the stories fade and the filings remain, the reality will be clear:

This was never about building a trading empire — it was about trading the story itself.

DisclaimerThe research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.