Brera Holdings $BREA: From Social-Impact Soccer to a Crypto Pump Machine

Executive Summary

Brera Holdings PLC (BREA) is an Irish-based holding company that debuted on Nasdaq in January 2023, promoting a vision of "social-impact, multi-club" football (soccer) ownership. Under the leadership of Executive Chairman Dan McClory—a veteran investment banker and Head of China at Boustead Securities—the company presented a plan to acquire and develop small football clubs into a global brand.

This report finds that Brera’s narrative has shifted sharply toward capital-markets engineering over sports management. In 2023 on The Friendly Bear podcast, McClory explains that when U.S. markets resumed China IPOs after the Covid pause, “some of these pop and drops” occurred as suppressed demand and heavy trading volumes drove sharp early upticks. He mentions that “in an almost racist way, they paused Chinese stocks being listed.” This has since been proven to have been driven by Chinese boiler room manipulation as mentioned at StopNasdaqChinaFraud.com and the creation of the SEC’s Cross-Border Task Force to combat “pump-and-dump” schemes. Brera has followed a similar market-driven pattern through aggressive share issuance, warrant offerings, a 1-for-10 reverse split, and a $300 million private placement—payable in USD or crypto—that pivots the company into a digital-asset treasury.

Key findings include:

Significant Governance Changes: Insider-controlled votes have authorized 10 billion new Class B shares and extended the board's share issuance authority for five years, severely diluting minority shareholder protections.

Substantial Conflicts of Interest: McClory’s dual role as Brera Chairman and a key figure at its placement agent, Boustead Securities, triggers formal FINRA conflict-of-interest rules

Homeless people and felons on the soccer team: Dan McClory, BREA’s Executive Chairman has been on several podcasts promoting the idea of inclusivity to an extreme degree. This provocative messaging was designed to generate media attention and draw a stark contrast with traditional, profit-driven football clubs.

Narrative Pivot: The company has abruptly transitioned from a social-justice soccer story to a Solana-based crypto treasury narrative, catalyzing extreme stock volatility.

Minimal Operational Substance: Italian sports holdings (Brera Milano, Juve Stabia, UYBA Volley) provide publicity but contribute minimal revenue, functioning primarily as a narrative engine for capital market activities.

Brera Holdings exhibits the hallmarks of a speculative microcap vehicle, where promotional themes—including strong ties to Chinese capital markets and now, digital assets—are used to attract investor interest and liquidity.

The Crypto Pivot: Following the "Crypto Cocktails" Playbook

The recent, abrupt shift of Brera Holdings into a "digital asset treasury" model is not an innovative strategy but a well-trodden path in the microcap arena. For market observers, this move places BREA squarely into a cohort of stocks often grouped under the moniker "Crypto Cocktails"—companies like KIDZ, BNMR, SBET, and OCTO that have leveraged crypto-themed narratives to generate explosive, often short-lived, speculation in their stocks.

This playbook is predictable:

The Struggling Shell: A publicly-listed company with a thin float, minimal revenues, and a struggling core business (e.g., kids' tutoring and education for KIDZ, sports betting for SBET, biotech for BNMR) seeks a catalyst to attract capital and investor attention.

The Narrative Pivot: The company announces a dramatic strategic shift into the crypto or blockchain space. This is typically a high-concept, low-detail announcement involving a "digital treasury," NFTs, or a blockchain-based platform. The vaguer and more ambitious the announcement ($300 million PIPE! Solana treasury!), the more effective it is at creating the kind of pop-and-drop trading spikes McClory described on the Friendly Bear podcast (around minute 4:30), where pent-up demand and heavy volumes fuel sharp early upticks.

The Liquidity Event: The news, amplified by press releases and promotional channels, triggers a frenzy among retail traders and momentum investors. For a company like BREA with an extremely thin float post-reverse split, this creates a powerful short squeeze, resulting in parabolic price increases of hundreds of percent in a single session.

The Dilution: The inflated share price and newfound investor interest create a perfect environment for the company to execute its primary function: raising capital by issuing new shares. This is where the pre-authorized 10 billion Class B shares and five-year issuance authority become critical tools for insiders

The Juicy Brera Squeeze: A Playbook Executed to Perfection

The Perfect Hook: The pivot wasn't just to "crypto"; it was specifically to Solana (SOL), the favored blockchain of the retail trading community, ensuring maximum hype and relevance on platforms like Twitter and Discord.

The Credible Anchor: Involvement of a name-brand placement agent, Cantor Fitzgerald, lent an air of legitimacy to the $300 million PIPE announcement, even though the deal's structure (accepting payment in volatile meme coins and stable coins) was highly unorthodox.

The Manufactured Squeeze: The combination of a microscopic float (approximately 710k shares post-split), triple-digit short borrow fees, and a crypto narrative guaranteed a violent squeeze. The 592% intraday surge was not an organic reaction to business fundamentals but a predictable mechanical outcome of the strategy.

The Insider Control: The September 2025 Extraordinary General Meeting (EGM) was the masterstroke that enabled this entire move. By securing the ability to issue billions of new shares before announcing the crypto PIPE, insiders positioned themselves to be the primary beneficiaries of any resulting price pump. They can now sell into the strength or issue shares to the PIPE investors at a premium, all while retaining control through their super-voting shares.

The Bottom Line: BREA's crypto treasury is not a genuine transformation into a digital asset company. It is the latest and most potent narrative fuel for its capital-markets engine. The playbook is well-known, and for BREA, it has worked exactly as designed.

BREA’s 592% intraday move on 9/18/2025

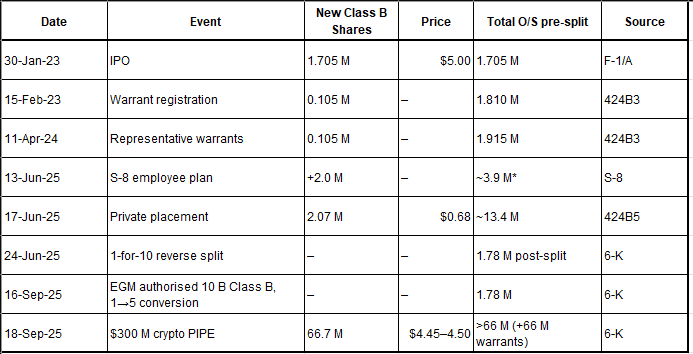

Capital-Structure Timeline

The 48-Hour Frenzy

Two days after its Extraordinary General Meeting (EGM), Brera announced a $300 million private placement open to payment in USD, USD Coin, Tether, or Solana (SOL), with Cantor Fitzgerald acting as sole placement agent.

The timing was critical: at the Sept 16, 2025, EGM insiders had just authorized 10 billion Class B shares, approved 1→5 Class A conversions, and extended the board’s share-issuance authority for five years—clearing the path for a massive raise.

With the post-split tradable float at only 710k shares, the news created the perfect thin-float squeeze.

The stock exploded from single digits to an intraday high of $52.95 (+592 %), before closing up roughly 225 %, while short-borrow fees spiked into triple-digit annualized rates.

Mainstream and crypto outlets amplified the excitement:

Financial Times (Sept 18 2025) reported that ARK Invest—the asset-management firm run by Cathie Wood—was named as an investor in the $300 million Solana-denominated placement, alongside Abu Dhabi’s Pulsar Group.

CoinDesk: coverage notes support from Pulsar Group (UAE), ARK Invest, Solana Foundation, and RockawayX.

Investors.com summarized the spike and reiterated Pulsar Group and ARK Invest participation.

The Social-Justice Soccer Narrative: A Foundation of Attention

Brera’s initial public narrative was built on themes of social impact and community-oriented football. Executive Chairman Dan McClory cultivated this image, using phrases like “make friends, not millionaires” and critiquing "evil in the world of football" to position Brera as a redistributive, philanthropic enterprise in the sports world.

Homeless people and felons on the soccer team

This narrative extended to the composition of the team itself. On public podcasts, such as the "Friendly Bear" podcast at the 8.15 minute mark, McClory promoted the idea of inclusivity to an extreme degree, suggesting the involvement of "homeless people and felons on the soccer team." at the :52 second mark of the podcast. This provocative messaging was designed to generate media attention and draw a stark contrast with traditional, profit-driven football clubs.

Dan McClory, BREA Executive Chairman:

Background, Family Ownership, and Conflicts

Background and Ties to China:

Dan McClory is the central figure guiding Brera’s strategy. His background is deeply rooted in investment banking and cross-border finance:

Current Roles: Head of China at Boustead Securities, where he focuses on assisting Chinese companies in raising capital and achieving U.S. IPOs. This positions him as a key intermediary between Chinese issuers and U.S. markets.

International Focus: He has extensive experience executing deals in Hong Kong, Toronto, London, Milan, and Zurich.

Boustead track record:

In 2025, China Liberal Education Holdings (NASDAQ: CLEU) became the subject of a federal criminal case alleging a coordinated “pump-and-dump” scheme. A March 2025 complaint describes misleading promotion by individuals posing as investment advisors, undisclosed share issuances, and aggressive dilution—followed by defendants dumping tens of millions of shares after artificially creating the appearance of strong demand. Once the undisclosed issuances were revealed, CLEU’s share price collapsed.

This legal action capped a dramatic destruction of shareholder value that began shortly after the company’s 2020 IPO, which was underwritten solely by Boustead Securities. The offering raised roughly $8 million through the sale of 1.33 million shares at $6.00 per share. In the years that followed, CLEU stock lost more than 98% of its value, eroding to just a few cents per share amid repeated dilutions and reverse splits—most recently a 1-for-15 consolidation in early 2024 and an 80-for-1 consolidation in 2025. Taken together, the criminal allegations, extreme dilution, and Boustead’s involvement in the IPO underscore CLEU as a cautionary example of both risky financial engineering at issuance and weak post-IPO governance

FINRA Sanctions for Supervisory Failures -

In November 2022, Boustead Securities was sanctioned by FINRA for deficiencies in its supervisory system related to customer participation in private placement offerings. The firm consented to these findings without admitting or denying the charges. This action highlights concerns about the firm's internal controls and oversight mechanisms.

Ownership and Control of BREA:

Dan McClory is BREA 's controlling shareholder. He acquired a majority stake, bringing his holdings to approximately 6.85 million shares (pre-reverse split), representing 54.5% ownership and 84% of voting power through super-voting Class A shares. This absolute control allows him to unilaterally direct strategic pivots and approve dilutive governance changes.

Documented Conflicts of Interest

Brera’s June 17, 2025 prospectus (Form 424B5) states that Daniel J. McClory is both Brera’s Executive Chairman and an “affiliated and associated person” of Boustead Securities and Sutter Securities, the very firms acting as placement agents for Brera’s financing. In clear terms: the man steering the company is tied to the bankers selling its stock.

That dual role triggered FINRA Rule 5121, which flags “conflicted” offerings and forces the appointment of a Qualified Independent Underwriter (QIU) to babysit the deal. The filing shows D. Boral Capital LLC was brought in to fill that role—an unusual safeguard that exists only when regulators see the potential for insiders to tilt the playing field.

For investors, this isn’t just boilerplate legalese; it’s the company itself conceding that the deal structure carries a built-in conflict of interest at the very top.

Capital Markets Strategy: The "Attention Creates Liquidity" Playbook

McClory’s philosophy, articulated on the Friendly Bear podcast, admires early-stage markets where "attention creates liquidity" and acknowledges the "pop-and-drop" behavior of Chinese microcap IPOs. These “pop-and-drops” have since been exposed as pump-and-dumps by The Bear Cave newsletter at StopNasdaqChinaFraud.com. Additionally, on September 5, 2025 the SEC announced the formation of The Cross-Border Task Force to combat market manipulation, such as “pump-and-dump” schemes.

Brera’s timeline is a textbook execution of this playbook:

Share Proliferation & Dilution (2023-2025): Between its IPO and mid-2025, Brera aggressively issued warrants, added a 2M-share S-8 option pool, and sold low-priced private placements (e.g., at $0.675). The share count grew more than sevenfold.

Reverse Stock Split (June 2025): To regain compliance with Nasdaq’s $1.00 minimum bid price requirement, Brera executed a 1-for-10 reverse stock split, consolidating the float to approximately 710,000 shares.

Consolidation of Control (Sept 2025 EGM): Insiders holding 84% voting power approved sweeping changes:

Authorized the issuance of 10 billion Class B shares.

Allowed a 1-for-5 conversion of super-voting Class A shares into Class B shares.

Cut the board quorum to three directors.

Extended share-issuance authority for five years.

Permitted directors to remove each other by a simple majority.

Effect: These changes grant management nearly unlimited ability to issue stock and alter governance with minimal minority shareholder oversight.

The Crypto Pivot & $300M PIPE (Sept 2025): Days after the EGM, Brera announced a $300 million private placement, payable in USD, USDC, USDT, or Solana (SOL), to fund a "Solana Digital Asset Treasury." This pivot from soccer to crypto, leveraging the thin float, triggered a massive short squeeze. The stock surged 592% intraday (from single digits to $52.95) as borrow fees rocketed to triple-digit APR, demonstrating the "liquidity" that extreme "attention" can create.

Conclusion: A Capital-Markets Machine

Brera Holdings’ journey from social-justice soccer to a crypto speculation vehicle is not a series of unrelated events but the coherent execution of a single strategy.

The Narrative Layer: The Italian clubs (Brera Milano, Juve Stabia, UYBA Volley) and the social-justice branding provide a constant stream of credible, attention-grabbing headlines for minimal cost.

The Structural Layer: Super-voting shares and the recent EGM changes cement insider control and create a mechanism for unlimited potential dilution.

The Execution Layer: McClory’s dual roles and Boustead affiliation facilitate repeated, conflicted capital raises. The crypto pivot is the latest and most extreme attention-grabbing mechanism to date.

What began as a football story has matured, as predicted by its Chairman, into a capital-markets engine. The company’s tangible operations remain minimal and symbolic, while its market valuation is driven primarily by financing mechanics, promotional themes, and the liquidity generated from narrative pivots. Investors should critically evaluate the substance of Brera’s operations and partnerships against their role as promotional themes in this strategy.

The Result: Relentless Dilution and Downward Pressure

Taken together, these layers form more than just a strategy — they create a self-reinforcing dilution machine. Each capital raise expands the share count, erodes existing holders’ ownership, and places persistent pressure on the stock price. With insider control firmly secured and minimal operational growth to offset dilution, Brera’s share price is likely to trend lower over time as new financings repeat the cycle. For outside investors, the key question is not whether another raise is coming, but how soon — and at what cost to their remaining equity.

Disclaimer

The research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.