Advent Technologies $ADN: How Paid Hype and a Hydrogen Fantasy Created a Ticking Time Bomb for Retail Investors

The $100 Billion Fantasy: How a Flashy Pitch and Paid Hype Left Shareholders and Retail Investors Holding an Empty Bag.

Advent Technologies Holdings, Inc. (NASDAQ: ADN) wants you to believe it’s positioned to dominate the hydrogen fuel cell industry, a supposed $100 billion opportunity. In reality, it’s a pandemic-era SPAC reverse merger that has incinerated shareholder value while insiders and affiliates cashed in. The ”billion dollar opportunity” narrative is being crafted not by an analyst, but a paid promoter Jack Marks. ADN is just the latest name in his promotional portfolio. Luring investors with words like “YUGE BREAKOUT… to PLUTO!!” creating artificial urgency.

Key Findings

ADN has never turned a profit, burns cash at a dangerous rate, and repeatedly raises capital through toxic dilutions (10-Q, Q2 2025).

The company’s technology is unproven at commercial scale, with years of delays and no meaningful revenue growth.

The stock has been aggressively promoted by Wall Street Reporter (WSR), a platform notorious for paid “Next Super Stock” campaigns that often coincide with price spikes, quickly followed by collapses. WSR has a long track record of marketing these stocks with flashy, get-rich-quick undertones, sometimes dangling lifestyle imagery and extravagant promises to lure desperate investors.

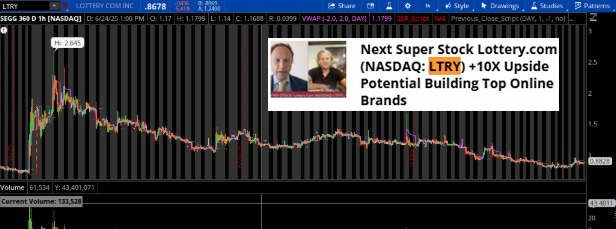

Multiple other WSR promotions (HOTH, SYTA, LTRY, LITM, etc.) have followed the same pattern: hype, spike and crash after being lured in by WSR’s “get rich quick” style marketing, retail investors were left holding the bag.

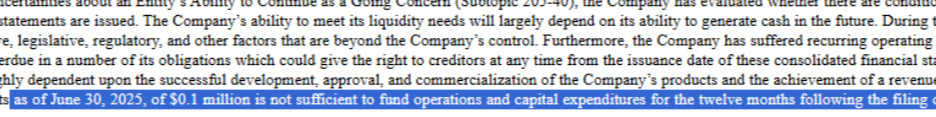

“Going Concern” Warning: Advent’s own filings admit “substantial doubt” about its ability to survive the next 12 months without new financing. One of the most severe warnings a public company can issue.

Management admits material weaknesses in internal controls over financial reporting: sweeping deficiencies in IT systems, segregation of duties, documentation, and journal entry oversight. The CEO is also acting CFO—making the financial reporting environment doubly precarious.

ADN is the latest in this conveyor belt of “emerging leaders” except the only thing emerging is the dilution.

1. ADN’s Origin Story – Born from a Pandemic SPAC

Advent Technologies (NASDAQ: ADN) went public in February 2021 at the absolute height of SPAC euphoria. The period when dozens of speculative, pre-revenue companies rushed to market with lofty promises and minimal scrutiny. ADN fits the pattern perfectly.

The AMCI Acquisition Corp. merger handed insiders and the SPAC sponsors millions of cheap shares and warrants while retail investors were fed a “multi-billion-dollar hydrogen economy” dream. The PIPE financing and cap table were designed to monetize hype, not to build a profitable, proven business.

From there, ADN followed the well-worn SPAC script: a string of press releases touting “transformational” acquisitions (SerEnergy, FES) and “global fuel cell leadership,” but filings show the deals drained cash, added liabilities, and triggered legal disputes.

Today, the result is undeniable:

Revenue is anemic and shrinking.

The balance sheet is propped up by toxic equity lines, ATMs, and reverse splits.

The share price has collapsed over 95% since listing.

The SPAC structure achieved exactly what it was built for: Insiders got liquidity, retail investors got left with losses.

By mid-2023, the capital structure told the real story. ADN installed two back-to-back equity taps: a $50 million purchase agreement with Lincoln Park Capital (April 2023) and a $50 million at-the-market program (June 2023), both under an S-3 shelf effective May 2023. These tools were built to sell stock “from time to time” into any strength, exactly the lifeline a promotion-driven microcap depends on.

The “global fuel cell leader” narrative then collided with reality in Europe. On July 25, 2024, Advent’s Danish subsidiary (SerEnergy/Advent Technologies A/S) was declared bankrupt; Advent’s 2024–2025 10-Qs say the company expects no residual assets and adjusted pro-formas accordingly. A related German arbitration tied to the SerEnergy/FES purchase agreement resulted in an unfavorable award of roughly €4.5 million.

As the stock fell below Nasdaq’s bid-price threshold, Advent executed a 1-for-30 reverse split approved April 30, 2024, and effective May 2024. This was not a one-off rescue move, it’s part of a well-worn playbook: reverse split to meet listing requirements, create a thin post-split float, then ride any spike in price before issuing more shares. The thin float makes the stock highly reactive to retail flows and promotional pushes, setting the stage for the next round of dilution.

What we did not find is also telling. Advent needs a constant flow of new capital to survive. On one side, it taps live equity lines and ATM programs to raise cash. On the other hand, it pays for promotional exposure to keep the stock price high enough to enable those financings. The SPAC set the cap table; the acquisitions consumed cash and added liabilities; the shelf, ATM, and equity line kept the paper flowing; the reverse split kept the listing alive and set it up for another round of never-ending dilution. The share price, meanwhile, has collapsed more than 95% from post-listing highs despite years of “pipeline” press releases and promotional appearances. The filings and corporate actions, not the marketing explain why.

Key timeline of corporate and capital events

Feb 4, 2021 – AMCI SPAC closes business combination with Advent; ticker changes to ADN

Feb 2021 – Acquisition of UltraCell

Aug 31, 2021 – Acquisitions of SerEnergy (Denmark) and FES (Germany)

Apr 10, 2023 – $50 M equity purchase agreement with Lincoln Park Capital

May 2, 2023 – S-3 shelf declared effective

Jun 2, 2023 – $50 M ATM program with H.C. Wainwright

Jul 25, 2024 – SerEnergy declared bankruptcy after failing to secure financing to continue operations; the company also lost a German arbitration case, resulting in a ~€4.5 M penalty.

May 2024 – 1-for-30 reverse split to maintain Nasdaq listing (sets the stage for the next round of pumping and dilution).

July/August 2025 - Wall Street Reporter begins coordinated pump-and-dump campaign, blasting “get rich quick” ADN emails to subscriber to drive retail buying ahead of dilution.

Who benefited from the structure

SPAC sponsor – Millions of founder shares and private placement warrants at nominal cost.

PIPE investors – Able to exit during the early post-merger hype, PIPE investors contributed to the never-ending waterfall of dilution that plagues most SPAC deals.

Equity line counterparty (Lincoln Park Capital) – Discounted share purchases over time, sold into any price spikes, contributing to the constant downward pressure on the stock.

ATM broker (H.C. Wainwright) – With no meaningful revenue and mounting losses, the company survives by repeatedly selling stock. The at-the-market (ATM) facility is not a backup tool, it is the lifeline. That ATM hangs over the market as a constant source of selling pressure, ensuring that whenever shares tick higher, new paper is dumped. Investors aren’t buying into growth; they’re buying into an endless cycle of dilution.

Management – Ability to fund operations without traditional bank debt or profitability, by selling equity into retail-driven rallies or manufactured rallies such as WSR (Wall street reporter) pumps.

2. Financial Reality – A Company on Life Support

Advent’s Q2 2025 10-Q flatly declares ‘substantial doubt’ about its ability to continue as a going concern. Management admits that with just $0.1 million in cash and a negative working capital of $27.8 million, the company can't sustain operations without immediate equity or debt financing.

The numbers in Advent Technologies’ latest quarterly report strip away any illusions about a thriving hydrogen innovator. In its Q2 2025 10-Q, Advent posted just $2.4 million in revenue for the quarter, a sharp decline from $3.0 million in the same period last year. Gross margins remain slim to nonexistent, and the company’s core business does not generate positive cash flow. The bottom line was even uglier: a net loss of $13.9 million for the quarter, extending an accumulated deficit that now stands at roughly $161 million.

The cash position tells the real story. As of June 30, 2025, Advent held just $7.6 million in cash and equivalents, barely enough to keep the lights on for two quarters at its current burn rate. This is not a company funding growth from operations; it is a company funding operations from dilution. The weakness is not theoretical. Advent’s subsidiaries are already collapsing into bankruptcy courts abroad, in Denmark over just €402,000, and in the Philippines via liquidation. The pattern is unmistakable: overextension, insolvency, and an inability to honor even basic obligations. A company that styles itself as a “global hydrogen leader” cannot even keep its own subsidiaries alive.

And Advent has mastered the mechanics of that equity treadmill.

On July 19, 2024, the company inked a $50 million common stock purchase agreement with a single institutional investor. The effect is constant supply of stock that weighs on the share price, but provides management with a drip-feed of liquidity.

This came on top of earlier cash-raising levers:

In April 2023, a $50 million equity purchase agreement with Lincoln Park Capital, a well-known microcap toxic financier.

In June 2023, a $50 million at-the-market (ATM) offering with H.C. Wainwright, another well-known microcap toxic financier.

Advent maintains a 200 million S-3 shelf registration, approved in 2023, that serves as a standing pipeline of dilution. Rather than a safety net, this shelf has become a tool for continuous cash grabs. Ensuring a steady flow of new shares into the market whenever the company needs to fund its relentless burn.

Each of these financing tools appears designed for one cynical purpose: to facilitate promotional pump and dump campaigns that prey on retail investors. The scheme works by using paid promotional events and hype-filled press releases to artificially inflate the stock price. Once retail investors are lured in by the manufactured excitement, the company and its financiers can sell, or rather "dump," their shares at inflated prices. When the Wall Street Reporter’s “Next Super Stock” spotlight hit ADN, the company's capital structure was already perfectly primed to dump shares into the resulting rally. We will elaborate on this mechanism in detail later in the report.

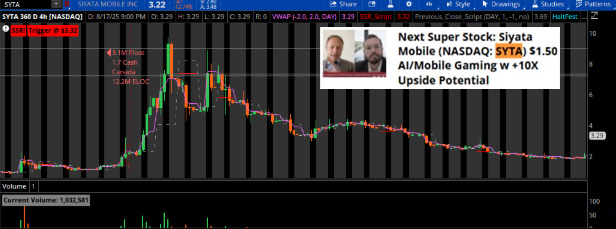

Some recent Wall Street Reporter examples collected from their email campaigns:SYTA

LTRY

LITM

This pattern is visible in filings: after each equity agreement, the company’s outstanding share count inflated higher, often coinciding with drops in share price as the new stock hit the market. For long-term shareholders, the effect has been devastating with more than 95% value destruction from post-SPAC highs, while intermediaries like Wainwright, equity line providers, and PIPE financiers extracted their economics up front. All at the expense of the shareholders, who keep getting diluted into oblivion.

The combination of minimal revenue, high burn, and serial dilution is the financial engine that makes compensated promotion attractive. ADN doesn’t need a sustained bull market to survive, it just needs short bursts of buying pressure to create windows for paper sales. The July 2024 $50M facility, like the ones before it, ensures that even the smallest spike in price can be monetized almost instantly.

"Going Concern": An Official Warning of Imminent Failure

The company's precarious financial position is not merely an outside observation; it is an officially declared risk. Advent's own SEC filings contain a "going concern" warning. This is an explicit statement from management and auditors required under accounting standards when there is "substantial doubt" about a company's ability to continue operating for the next twelve months.

A summary of the company's most recent 10-Q filing explicitly notes: "Management discloses substantial doubt about the company's ability to continue as a going concern". This is one of the most severe warnings a public company can issue and signals a high probability of insolvency or bankruptcy without immediate and substantial new financing.

Advent Technologies: A House Built on Weak Internal Controls

Advent has openly admitted, across multiple filings, that it suffers from material weaknesses in its system of internal controls over financial reporting (ICFR). These weaknesses are not trivial, they cut directly to the company’s ability to produce reliable financial statements.

Company Admission of Failure: Advent disclosed that management “concluded that the Company’s internal control over financial reporting was not effective” as of both December 31, 2023 and December 31, 2024. This is not a temporary slip-up, it is a systemic, ongoing problem.

Inability to File on Time: The weakness was so severe that Advent failed to timely file its 10-K for the fiscal year ended December 31, 2023 and was late with multiple 10-Qs in 2024. This demonstrates that the accounting function is not just weak, but fundamentally broken.

Key Leadership Failures: The deficiencies were tied directly to lack of effective oversight by the CFO, followed by the CFO’s resignation shortly thereafter. That timing is damning it suggests the very officer responsible for financial reporting could not or would not stand behind the company’s internal processes.

Risk of Misstatements: By law, Advent is required to disclose the impact of these weaknesses. Their own filing admits that the weaknesses “could result in material misstatements” of its financials.

Plain English: investors cannot rely on the reported numbers.No Clear End in Sight: Management claims to be “working to remediate,” but explicitly warns there is no assurance the remediation will be fully developed and implemented. In other words, this could drag on indefinitely.

Impact on Financing: Advent concedes that unresolved weaknesses will make it harder to obtain financing or will require paying higher costs to lenders and investors. For a cash-burning company reliant on capital markets, this is an existential problem.

Weak internal controls + CFO turnover is one of the clearest historical precursors to financial restatements, fraud allegations, or SEC investigations. Investors should ask themselves a simple question:

If the company itself admits its financial reporting is unreliable, how much confidence can anyone place in the revenue claims, grant accounting, or cash burn disclosures Advent promotes to the market?

Advent’s own filings have already given the answer: shareholders cannot.

A significant and troubling board-level connection

Advent Technologies and Siyata Mobile (NASDAQ: SYTA), another micro-cap company with a history of catastrophic stock performance and financial struggles.

Here’s the visual proof: both Advent Technologies and Siyata Mobile tied at the board level, have followed the same catastrophic collapse pattern.

Gary Herman, Advent's CEO, also sits on the board of directors of Siyata Mobile.

Marc Seelenfreund, an Advent director, is the founder and CEO of Siyata Mobile.

A quick look at Siyata Mobile's chart reveals a similar trajectory to Advent's. A total melt down from its highs, followed by reverse splits and dilution with a never ending decline. The shared collapse is more than coincidence. It’s a stark echo of micro-cap governance failure.

3. Technology Claims vs. Market Reality

ADN’s pitch is that it makes “next-generation” high-temperature proton exchange membrane (HT-PEM) fuel cells, supposedly better for efficiency and flexibility. But here’s the reality:

No major commercial customers have been disclosed.

No utility-scale deployments in operation.

ADN’s most notable project announcements are often memorandums of understanding (MOUs) which are non-binding and easy to cancel.

The hydrogen fuel cell industry has enormous capital requirements. With rival listed incumbents which are both struggling despite their scale.

ADN’s filings are littered with vague “pipeline” descriptions and references to government grants, but actual revenue from product sales remains negligible.

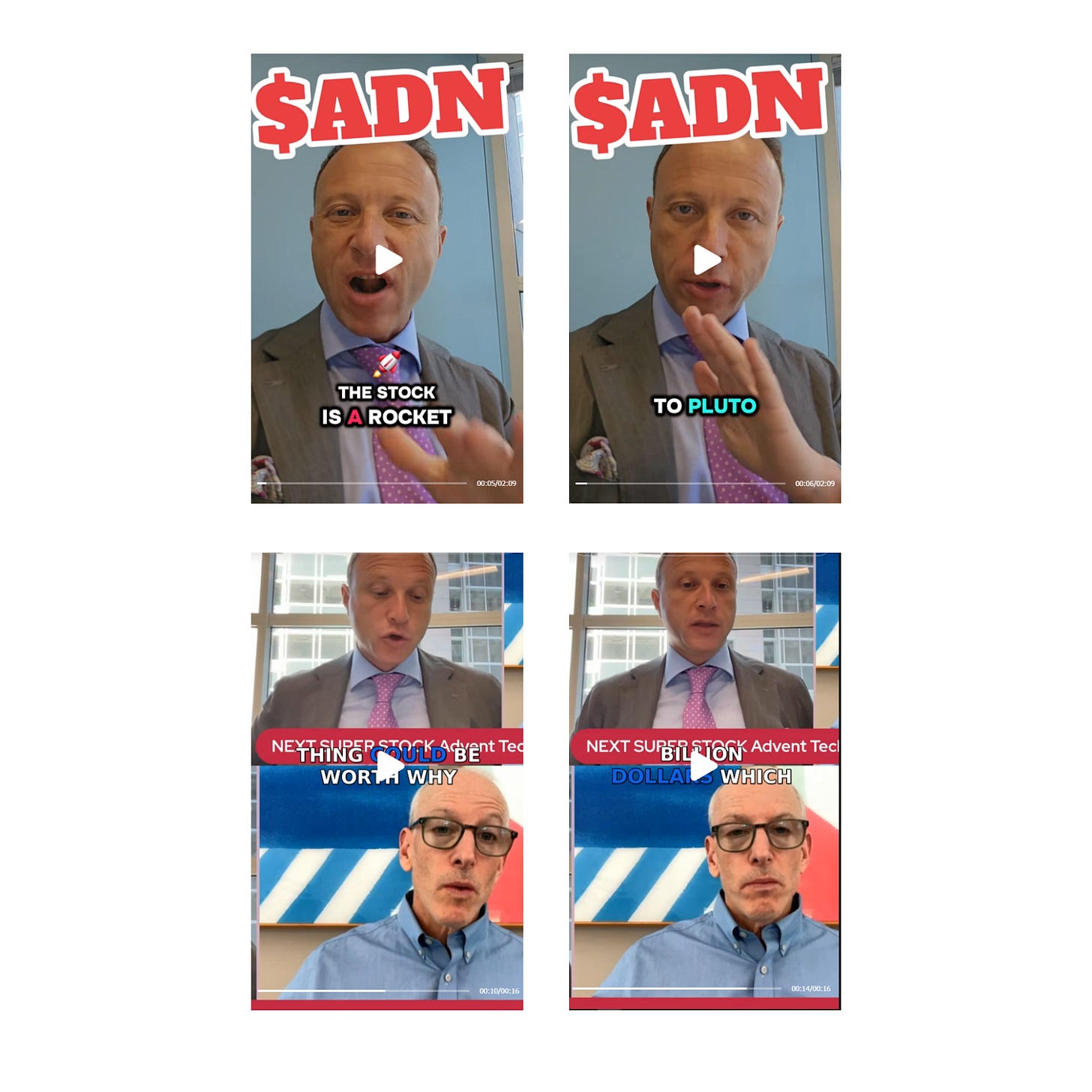

4. Enter the Promoter – Wall Street Reporter aka Temu Wolf of Wall Street

Wall Street Reporter (WSR) is a self-described “financial media” platform that runs the Next Super Stock series. A paid promotional program for microcaps.

WSR’s own disclaimer admits it is compensated in cash and/or stock for featuring companies. That’s not journalism, it’s advertising disguised as investment insight.

The host uses a formula:

Aggressive future projections (“This could be a $100 billion company”).

Rapid-fire investor-friendly talking points, often supplied by the company.

Stock price anchoring, suggesting massive upside in a short period.

Using materialism like Lamborghinis in his video artwork to indicate get rich quick to unsuspecting investors.

The so-called “Wall Street Reporter” is nothing more than a stock promoter in disguise. He dresses in a suit and tie to project credibility, but the pitch quickly devolves into get-rich-quick promises of easy money and Lamborghinis. It’s a classic penny-stock hustle, professional packaging masking a boiler-room script.

On top of that, the operation extends across multiple platforms to maximize its reach. The promotional ecosystem creates a direct funnel to @pennystockbillionaire, a Telegram channel that pushes a Linktree page featuring wallstreetreporter.com. This Linktree also promotes a paid Whop membership for $195.00/month. Revealing clear cross-branding from a TikTok persona to the WSR properties. The channel amplifies the hype with classic stock-tout language, posting messages like “YUGE BREAKOUT… to PLUTO!!” and creating artificial urgency with claims like “only 2M shares out.” It is a textbook example of a modern stock promotion playbook.

5. The ADN Pump – Transcript Evidence

In WSR’s Next Super Stock episode on ADN, the host hammers home the upside. All while wearing a suit and tie in front of signage styled to mimic the Wall Street Journal, a setup clearly designed to confuse viewers into granting him a false sense of credibility:

“You guys are like in the perfect storm… Hydrogen fuel cells, $100 billion opportunity, huge government push, I mean this could be the next Tesla for fuel cells!”

This isn’t analysis. It’s scripted hype. No mention of ADN’s negative margins, dilution history, or lack of commercial traction.

The pump coincided with a sharp increase in trading volume and a short-lived price bump, a pattern seen in other WSR promotions.

6. A Pattern, Not a Coincidence — Unmasking the Paid Pump Maestro

Advent Technologies' push into public attention didn’t happen by accident. Behind the “Next Super Stock” livestream was Jack Marks, a man who has built Wall Street Reporter into a promotional engine preying on vulnerable microcap retail investors. He claims to be “The trillion dollar man,” yet his history shows a pattern of deception from the very beginning. Within just a year of starting his digital operation, Marks was charged by the SEC, which charged him for the exact practice that remains the core of his business today: disguising paid advertisements as legitimate financial journalism.

Marks has held the title of publisher and CEO of Wall Street Reporter since relaunching its digital version in 1997. His platform markets itself as giving investors direct access to CEOs of high-potential companies. But the wording reveals the true model, these are paid campaigns, not earned coverage. In his LinkedIn bio, he claims to have gone to Harvard, a prestigious school, a credential we have been unable to verify and believe to be false. This embellishment of his own background seems to perfectly mirror his business model: presenting something as more credible and prestigious than it actually is, whether it's a struggling microcap company or his own resume.

Public records show Wall Street Reporter isn’t offering “visibility,” instead they’re selling smoke and mirrors. Marks shamelessly pitches CEOs on the idea that his livestreams and email spam will put them in front of “thousands of fund managers, analysts, and institutional investors.” In reality, it’s a boiler-room style hustle in which the real targets are unsuspecting retail investors who mistake his staged hype sessions for legitimate journalism. (Wall Street Reporter “Companies” pitch)

Even more telling: a case against Starwood Media Group (alleged to be connected to WSR) with Jack Marks (formerly Jacob Mestechkin) included a lawsuit by the SEC for violating Section 17(b) by promoting paid stocks without proper disclosures. Marks settled the case by admitting no guilt but agreed to permanent injunctive relief and a fine. (SEC Litigation Release) This is the same legal framework WSR claims to now follow, yet ADN and dozens of others still receive enthusiastically hyped interviews with buried disclaimers.

This same hype formula has repeatedly been applied to other microcaps:

Hoth Therapeutics (HOTH) – promoted as a “billion-dollar biotech” → collapsed over 80% within months.

Siyata Mobile (SYTA) – hyped as the “hottest AI gaming stock” → down over 90% from promotion peak.

Snow Lake Resources (LITM) – pumped as “Canada’s Biggest Lithium Mine!”

The cycle is the same:

Company pays WSR.

WSR pumps story to retail.

Stock spikes briefly.

Company sells shares into the hype.

Price collapses.

The case against Admirers of flashy claims and shiny livestreams is simple: patterns don’t lie. When the same person, with the same platform, uses the same narrative tactics across multiple small-cap companies, especially those in desperate financial straits, the result is a well-worn tape.

ADN is just the latest name to feature in Jack Marks’ promotional portfolio. His role with Advent Tech is that of a paid narrator, not an analyst. This adds a layer of danger: those buying into “$100 billion fuel cell plays” are doing so with their eyes on marketing hypnotism, not fundamentals.

7. Conclusion – ADN’s Road Ahead is Paved with Dilution

ADN has all the hallmarks of a classic microcap trap:

Hype-heavy industry narrative (hydrogen fuel cells).

Chronic unprofitability and small cash balance.

Reliance on dilutive financing.

Paid promotion to unsophisticated investors.

When paired with a promoter like WSR, the result is predictable, temporary excitement, permanent losses.

Investors should demand hard proof of commercial success before trusting ADN’s lofty projections. Until then, ADN looks less like a $100 billion opportunity and more like the next chapter in WSR’s long book of pump-and-dump failures.

Disclaimer

The research, commentary, reports, and other materials published by Fugazi Research LLC (“Fugazi Research,” “we,” “us,” or “our,”) are provided solely for informational and educational purposes. Fugazi Research is an independent research publisher and is not registered as an investment adviser, broker-dealer, or commodity trading advisor with the U.S. Securities and Exchange Commission or any other regulatory authority.

All content published by Fugazi Research represents our opinions as of the date of publication and is based on publicly available information, independent research, interviews, and analytical judgment. Our opinions are inherently subjective, may be incomplete, and are subject to change at any time without notice. We do not undertake any obligation to update or revise our content to reflect subsequent events, market developments, or new information.

Nothing published by Fugazi Research constitutes investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security or financial instrument. The information should not be construed as tailored to the investment objectives, financial situation, or particular needs of any individual or entity. Readers should conduct their own independent research and consult their own financial, legal, and tax advisors before making any investment decision.

Fugazi Research, its affiliates, principals, members, employees, consultants, or clients may have positions—long, short, or otherwise—in the securities discussed, and such positions may change at any time for any reason, including risk management, market conditions, or liquidity considerations. We may trade in securities covered by our research before, during, or after publication, and we may reduce, close, or reverse positions at any time without notice. Readers should assume that Fugazi Research has a financial interest in the securities discussed.

Our research may include forward-looking statements, estimates, projections, or opinions that involve known and unknown risks, uncertainties, and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

While we believe the information we present is accurate and reliable, it is provided “as is” and “as available,” without any representation or warranty, express or implied, as to accuracy, completeness, timeliness, or fitness for any particular purpose. Fugazi Research disclaims any liability for errors, omissions, or losses arising from the use of our content.

By accessing or using Fugazi Research’s materials, you acknowledge and agree that Fugazi Research shall not be liable for any direct, indirect, incidental, consequential, or other losses arising from reliance on our research or opinions. Use of our content is entirely at your own risk.

All content is the intellectual property of Fugazi Research and may not be reproduced, distributed, or shared without prior written consent.